Americans for Tax Reform director of state affairs Patrick Gleason wrote an op-ed for Forbes detailing the issues with implementing municipal broadband.

The inherent problem with municipal broadband is that government entities are incapable of fairly competing in the free market, as they are taxpayer-backed and therefore able to charge less for a service than it actually costs. Private businesses cannot do this, as doing so would result in bankruptcy.

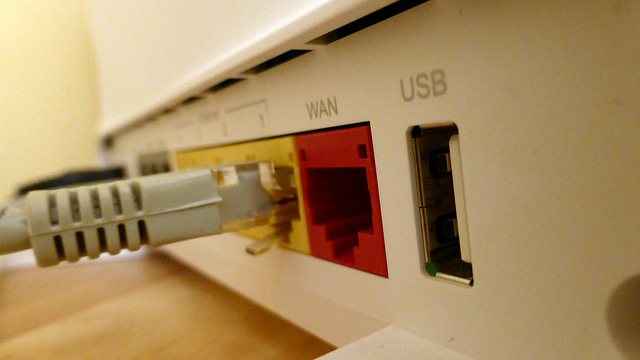

The costs of building out and maintaining broadband networks are considerable. It is not a fiscally sound use of scarce taxpayer dollars for governments to compete with billion dollar networks already in existence.

Townhall ran an article by Ky Sisson regarding a recently revealed scandal involving Democratic Kansas gubernatorial candidate, Paul Davis.

During Brownback’s first term, he supported substantial tax reform that reduced the top income tax rate by 25 percent, lowered the state sales tax, and did away with a tax on small business income. Though many liberal opponents disagreed with his approach, the advocacy group, Americans for Tax Reform praised Governor Brownback and said that the “tax cuts are working.”