Each day leading up to Christmas, ATR will release a new addition to its Naughty and Nice List. Check back for updates!

NICE: Kentucky Senate President Robert Stivers and House Speaker David Osborne for delivering a full phase out of the Kentucky income tax.

NAUGHTY: The Council of the District of Columbia for their genius plan to increase tourism by raising hotel taxes.

NAUGHTY: The U.S. Chamber of Commerce for endorsing 10 House Democrats who voted for a $3.5 trillion tax-and-spend bill that the Chamber key-voted against. The Chamber vowed that “no member of Congress can achieve the support of the business community if they vote to pass this bill as currently constructed.” Every House Democrat endorsed by the Chamber did in fact vote in favor of the partisan $3.5 trillion bill.

All 10 Chamber-endorsed Democrats also voted for the Inflation Reduction Act, while 9 voted in support of the PRO Act. The Chamber key-voted against both pieces of legislation.

We would gift the Chamber of Commerce a lump of coal for Christmas, but they would just support taxing it.

NAUGHTY: Senator Amy Klobuchar (D-Minn.) for trying to expand government control over the economy with Trojan horse antitrust bills. Luckily for taxpayers, Klobuchar has failed every step of the way.

NICE: North Carolina Senate Leader Phil Berger, House Speaker Tim Moore, Senate Majority Leader Paul Newton, House Majority Leader John Bell, and Representative Jason Saine, for enacting a budget last year that will cut North Carolina’s flat personal income tax rate on January 1, 2023 and again in each of the subsequent three years. The budget that enacted that income tax relief will also eliminate the state’s corporate tax entirely by the end of 2026.

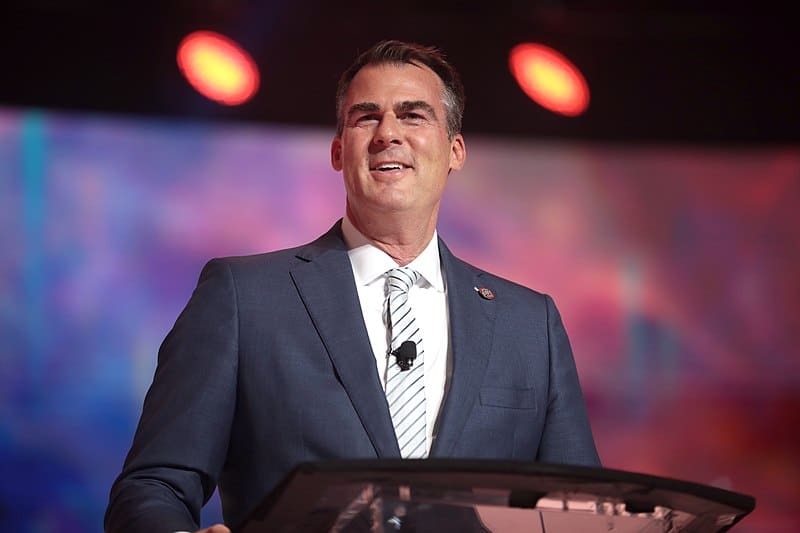

NICE: Governor Kevin Stitt (R-Okla.) for fearlessly supporting tax cuts, school choice, conservative improvements to the criminal justice system and for defeating well-funded tax-hiker Joy Hofmeister.

NICE: Governor Glenn Youngkin (R-Va.) for his leadership in providing significant tax relief to Virginia households and businesses.

NICE: Governor Doug Burgum (R-N.D.) for his leadership in laying out a plan for state income tax relief, moving North Dakota to a 1.5% flat rate, the lowest flat rate in the nation, with an eventual goal of elimination of the tax.

As noted in his Dec. 7, 2022 address:

“Every North Dakota income taxpayer will benefit from this plan, which will make North Dakota the lowest flat-tax state in the nation. This will give us an advantage as we compete against other states for workers. And it puts on a path toward eventually zeroing out our individual income tax and joining the eight states that don’t have individual income tax. These include some of our nation’s fastest-growing states and ones with whom we compete for workers in the energy industry 5 and other sectors, including Alaska, Texas and Wyoming, and our neighbor South Dakota.

We’re grateful to Tax Commissioner Kroshus along with Rep. Headland, Sen. Meyer, Sen. Kannianen, Rep. Bosch, and Rep. Dockter for their leadership on this proposal. This plan expands upon the income tax credit package, introduced by Rep. Heinert, which the legislature approved and was signed into law in November of last year.

To show working families that we understand their plight and that tax relief is a priority for this assembly, we urge you to expedite this income tax relief legislation and make it one of the first bills to cross my desk.”

NAUGHTY: U.S. Trade Representative ambassador Katherine Tai for reversing decades of bipartisan trade policy at the World Trade Organization and gave away American intellectual property rights, the backbone of America’s innovation ecosystem. In addition, Amb. Tai renewed tariffs on imports from China while allowing the exclusions process to lapse causing Treasury to increase its “revenue” by taking an extra $50 billion from Americans.

NICE: State Senator Kirk deViere (R-N.C.) North Carolina Senator Kirk deViere, for helping enact a bipartisan budget last year that will cut NC’s flat personal income tax rate on January 1, 2023 and again in each of the subsequent three years. As one of four Democrats who voted for that budget, Senator deViere provided a veto-proof majority, which drew the ire of NC’s leading Democrat, Governor Roy Cooper. The budget that enacted that income tax relief will also eliminate the state’s corporate tax entirely by the end of 2026. As punishment for the role he played in helping Republicans enact income tax relief, Governor Cooper backed a challenger who defeated Senator deViere in the May Democratic primary. Senator deViere sacrificed his political job in the name of providing tax relief to millions of households and small businesses.

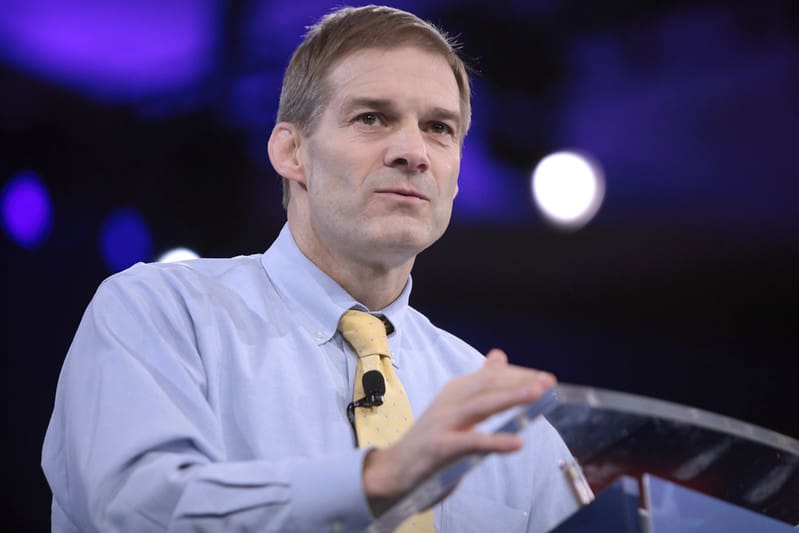

NICE: Incoming House Judiciary Chairman Jim Jordan (R-Ohio) for leading the conservative charge against the left’s antitrust Trojan horses and holding the Biden FTC and DOJ accountable for flagrant abuses of taxpayer resources.

NAUGHTY: FTC Chair Lina Khan for being at the forefront of the Biden administration’s abuse of government power to push a woke social agenda. Khan gave a keynote address at a far-left organization proposing a “paradigm shift” that would allow antitrust law to direct specific economic outcomes via government and legal “intervention.” Khan has also employed “unpaid consultants” from the ultra-woke Omidyar network to shape agency views on antitrust and economic policy. Since her bait-and-switch confirmation last summer, Khan has ripped up longstanding bipartisan norms in her quest to put every company in a “Mother-May-I” relationship with Biden bureaucrats.

NICE: Jon Caldara, President of the Independence Institute for once again leading a successful effort to cut Colorado’s flat income tax rate. He spearheaded Proposition 121, a reduction in the state income tax rate from 4.55% to 4.40%, saving the average taxpayer around $120 annually. Colorado voters approved the measure 65% – 35%.

NICE: Congresswoman Carol Miller (R-W. Va.) for introducing the Saving Gig Economy Taxpayers Act and the Emergency Taxpayer Paperwork and Audit Relief Act to fix the IRS 1099-K tax paperwork nightmare imposed by congressional Democrats and President Biden. Miller’s bill is supported by ATR and is rapidly gaining momentum.

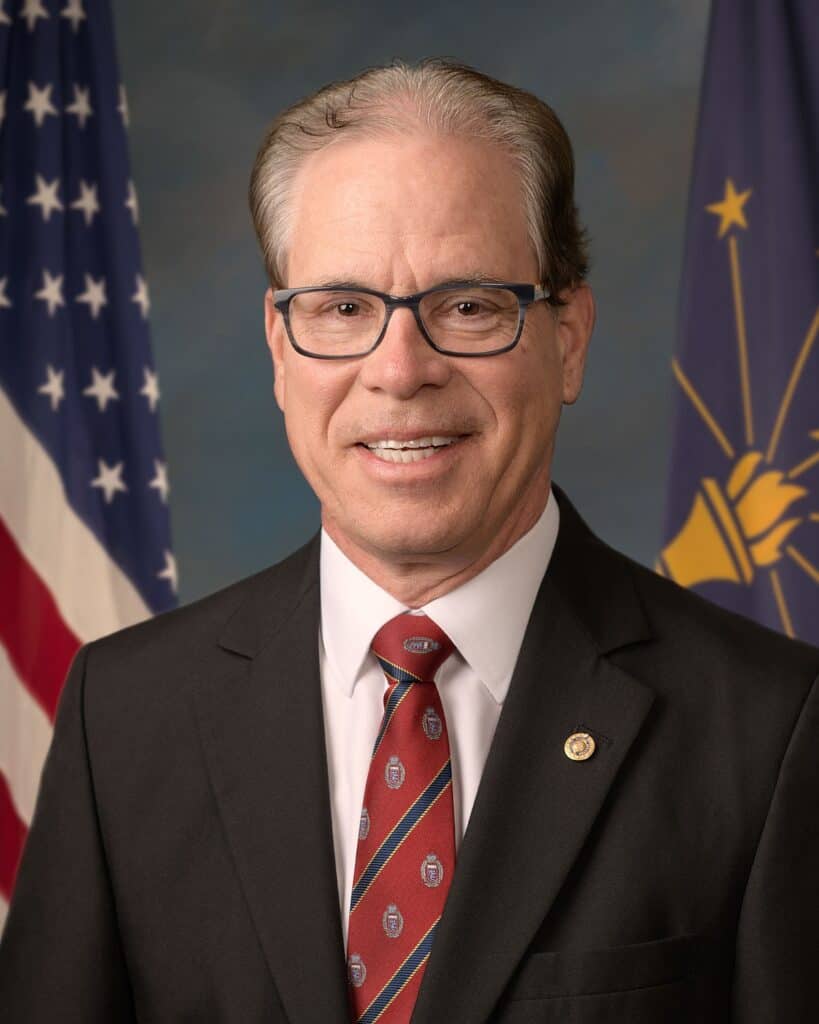

NICE: Senator Mike Braun (R-Ind.) for introducing the “Simplify, Don’t Amplify the IRS Act.” This legislation would implement reforms that hold the IRS accountable and protect taxpayers.

NICE: Jimmy Patronis, Chief Financial Officer of Florida for divesting the state of Florida from BlackRock. Patronis said: “Florida’s Treasury Division is divesting from BlackRock because they have openly stated they’ve got other goals than producing returns.”

NAUGHTY: Sen. Joe Manchin (D-W. Va.) for breaking his promise to West Virginians to not raise taxes. Manchin had promised WV voters that he could not look them in the eye and vote for a tax increase until he know the government was running efficiently. But he broke the promise by voting for the dishonestly named Inflation Reduction Act, which included a long list of tax increases.

NICE: Sen. Ted Cruz (R-Texas) for introducing the Senate bill to end the inflation tax on capital gains.

NICE: Congressman Warren Davidson (R-Ohio) for introducing the House bill to end the inflation tax on capital gains.

NICE: Arizona Senate President Pro Tempore Vince Leach (R-Legislative District 11) for delivering significant policy wins including the largest tax cut in state history and the largest expansion of school choice in the country. This was achieved with just a one-vote working majority in the state Senate.

NICE: Senator Ron Johnson (R-Wis.) for standing up for the right of adult smokers to quit through proven reduced risk vaping technologies, and for joining the #WeVapeWeVote tour and signing @savevape bus, Ron Johnson is a worthy addition to ATR’s 2022 NICE list!

Stay tuned for daily updates to this list!