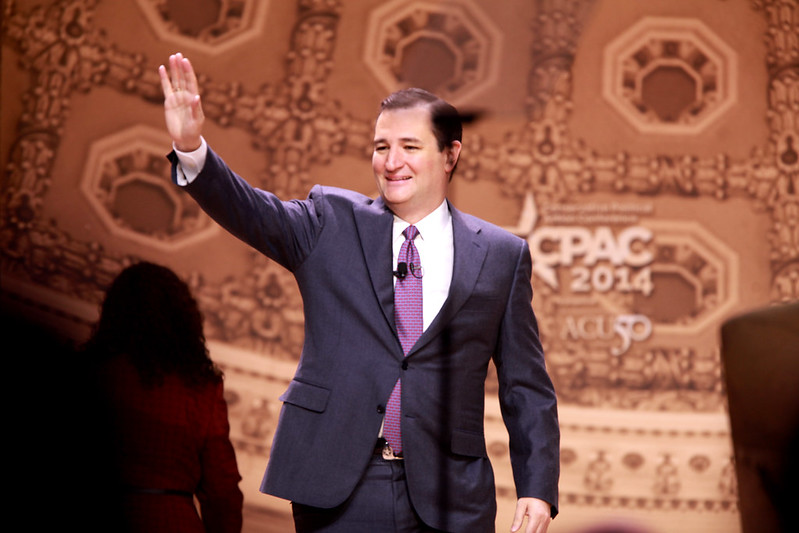

Senator Ted Cruz (R-Texas) has introduced “The Reinvigorating the Economy, Creating Opportunity for Every Vocation, Employer, Retiree, and Youth (RECOVERY) Act,” legislation designed to help the American economy continue recovering from the Coronavirus pandemic.

Here are several provisions that will help the economy recover and get Americans safely back to work.

Tax credits for employee testing and personal protective equipment

The RECOVERY Act provides a $150 tax credit to businesses that test their employees for Coronavirus on a biweekly basis for the remainder of 2020. This tax credit provides a direct incentive for employers to implement robust testing programs that keep their employees safe.

In addition, the Cruz bill establishes several tax credits designed to foster the conditions for businesses to safely reopen and operate. Employers can claim 50 percent of the cost of qualified expenses as a credit against applicable employment taxes on a quarterly basis.

Employers can claim a credit between $500 to $1,000 per employee depending on the size of their business. Qualified expenses include providing personal protective equipment for employees as well as reconfiguring and retrofitting workspaces.

Right to Test Act and FDA reciprocity

The RECOVERY Act includes the “Right to Test Act,” legislation that would allow states to approve and distribute Coronavirus tests as long as the state or federal government has declared a public health emergency. This would empower states to bypass FDA approval and drastically ramp up our testing capacity.

We already know what happens when Washington bureaucrats are in charge of developing and producing Coronavirus testing. The Center for Disease Control (CDC) took weeks to develop a Coronavirus test after the pandemic reached our borders, only to contaminate the first round of testing kits and completely botch the rollout.

The RECOVERY Act also establishes a reciprocal marketing approval process for COVID-19 drugs, biological products, and medical devices. This bill allows the sale of COVID-19 treatments or cures in the United States that have not yet been approved by the FDA if the product has already been approved in other countries.

Product sponsors must meet several criteria in order to sell in the U.S.

The FDA is notoriously slow at approving new drugs. On average, it takes 90.3 months for pharmaceuticals to go through the development and approval process, imposing immense R&D costs on manufacturers. In the middle of a global pandemic, we simply can’t afford to have the government slow things down more than they already do.

Liability protection for businesses

The RECOVERY Act establishes a liability shield for businesses operating during the Coronavirus pandemic.

This provision prevents businesses and/or individuals from being held liable in any Coronavirus exposure action unless the plaintiff can conclusively prove that:

- The businesses or individual were not making “reasonable efforts in light of all the circumstances” to comply with all applicable government standards at the time of the alleged exposure.

- The business or individual engaged in “gross negligence or willful misconduct” that caused the accidental exposure to COVID-19.

- The accidental exposure caused the plaintiff personal injury.

As our economy begins to turn the corner on COVID-19, a liability protection for businesses that have acted in good faith to keep their customers and employees safe is absolutely crucial to getting Americans safely back to work. This provision prevents trial lawyers from cashing in on the crisis with predatory and abusive legislation.

Payroll tax holiday for employers and employees

The RECOVERY Act temporarily suspends the payroll tax for employers and employees from the date of enactment through the end of 2020. This payroll tax holiday will lower the cost to businesses for hiring new employees, accelerating the reopening process and continuing to get Americans safely back to work.

This legislation builds on President Trump’s payroll tax executive order which deferred Social Security payroll taxes from September 1 to December 31, 2020. This proposal makes the moratorium permanent so that taxpayers do not have to pay back payroll tax relief next year.

Ways and Means Republican Leader Kevin Brady (R-Texas) has introduced similar legislation in the House of Representatives.

Indexing capital gains to inflation

The RECOVERY Act ends the taxation of inflationary gains by indexing the calculation of capital gains taxes to inflation. Under current law, the capital gains tax fails to account for gains that are based on inflation. This unfairly exposes taxpayers to additional taxation.

For example, an investor makes a capital investment of $1,000 in 2000 and sells that investment for $2,000 in 2017 will be taxed for a $1,000 gain at a top capital gains tax rate of 23.8 percent. After adjusting for inflation, the “true gain” is much lower – just $579. (1,000 in 2000 – $1,421 in 2017).

Ending the inflation tax would also benefit millions of middle class households. ATR looked at Internal Revenue Service data from 2017 (the most recent available data) to determine what percentage of middle class households had a capital gains filing:

- 25,494,330 American households had a capital gains filing

- 13,730,710 (53%) made less than $100k

- 20,466,770 (80%) made less than $200k

The breakdown for all 50 states is here.

Full business expensing

The RECOVERY Act would implement permanent full business expensing for qualified property. This would allow businesses to deduct the cost of new investments (machinery, equipment, etc.) in the year they are made.

There are several benefits to this policy. First, it incentivizes new investment, leading to greater economic productivity, job growth and higher wages. Second, it simplifies the tax code by equalizing the tax treatment of new investments with other business expenses such as wages, rent, and healthcare costs.

In a post COVID-19 world, full expensing will help businesses make vital investments in the coming months and years as they seek to bring workers back, onshore manufacturing capabilities, and ramp up production.

Deregulation

The RECOVERY Act would enact the “REINS Act,” legislation that overhauls the regulatory process and strengthen Congressional oversight of agency rulemaking.

The legislation also includes a provision that permanently repeals regulations that have been waived or suspended during the Coronavirus pandemic and creates a regulatory review commission for Congress to reinstate rules if they are truly needed. If for some reason the regulation is truly needed in order for agencies to function properly, Congress can reinstate the rule after recommendation from the commissions.

Instead of using the crisis to consolidate more power in the federal government’s hands, President Trump and his administration have made deregulation a central part of the Coronavirus response. State and local governments have followed suit, leading to the suspension of over 800 rules and regulations nationwide.

ATR has kept a running list of these waived regulations, which you can view here.

529 expansion

The RECOVERY Act allows Americans to use 529s for K-12 expenses for students engaged in home learning including students enrolled in public, private, or religious school and students that are homeschooled through the end of 2022.

529s are tax advantaged savings accounts that allow parents to save and invest after-tax income for education costs. Any money earned through 529 investment is tax-free, making these plans a popular choice for parents looking to save for future education expenses.

Qualified expenses include curriculum materials, books, online educational materials, tutoring costs, fees for standardized testing, and expenses for students with disabilities.

The coronavirus pandemic has resulted in additional costs for American families stemming from the need to ensure schools openly safely and the implementation of online and distance learning. These new costs are exacerbated by the financial hardships that Americans are experiencing across the country due to a lost job, or reduction in work hours.

Expanding HSAs by enacting the Pandemic Healthcare Access Act

The RECOVERY Act also includes Senator Cruz’s “Pandemic Healthcare Access Act,” legislation that would allow all healthcare plans to use Health Savings Accounts throughout the Coronavirus pandemic.

Currently, there is a mandate that any American wanting to open or contribute to an HSA must be on a high-deductible health plan.

Senator Cruz’s legislation would pause this mandate in order to help mitigate the pandemic by Americans in Medicare, Affordable Care Act health plans, TRICARE, the VA, Indian Health Service and any employer plan to use HSAs. It will also help individuals pay for their deductible or any increased health care costs, allow HSA funds to pay for direct primary care, and allow telemedicine below the deductible.