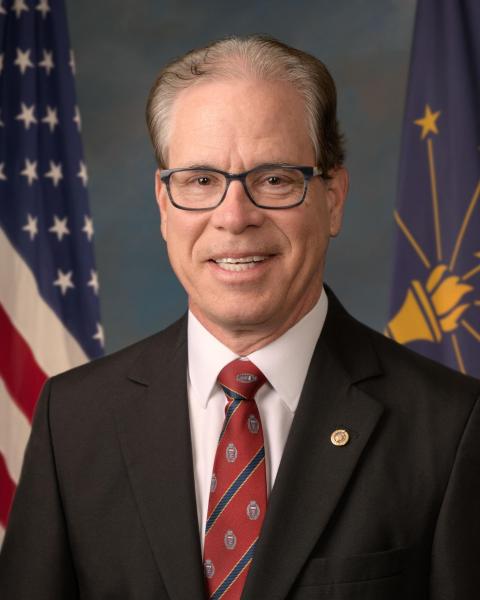

Senate Republican Mike Braun (R-Ind.) has introduced S. Amdt #3114 to S.Con Res. 14, the Fiscal Year 2022 Budget Resolution. ATR urges Senators to support and vote YES on this amendment.

In a last-minute addition to the partisan $1.9 trillion Biden spending plan in March, Democrats snuck a provision into the bill prohibiting states from cutting taxes. Senator Braun’s amendment would repeal this provision, allowing states to cut taxes.

The Democrat state tax cut ban is an attempt to prevent tax competition as Democrat-run states are failing to compete well with low-tax states. Competition between low-tax states and high- states tax allows voters to see a clear contrast between success and failure. Democrats know that taxpayers have already been voting with their feet. Over the last decade, millions of people and jobs have moved from high-tax states into states with low or no income taxes, and the ability to work remotely will only amplify this trend.

States such as New York, California and Illinois —which have been spending recklessly for decades —will still be allowed to use the bill’s funds to directly grow the size of government or bail out government union pension funds.

There are currently eight states —Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming —that do not impose income taxes of any kind, and this number is expected to increase in the coming years.

Congressional Democrats have no business dictating to states whether they can or cannot cut taxes. Lawmakers should immediately repeal this prohibition by voting YES on Senator Braun’s amendment.