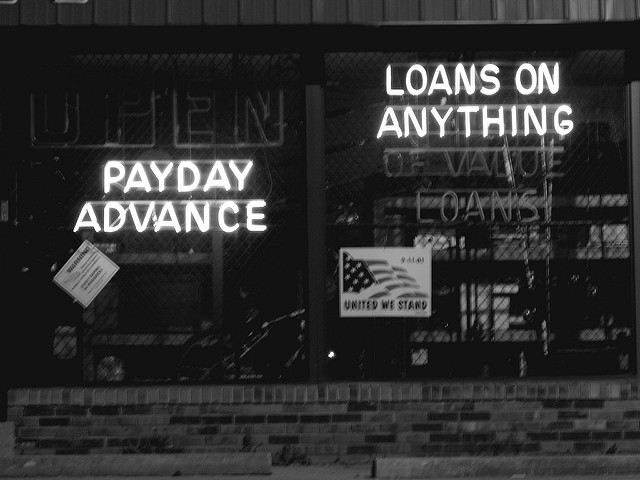

ATR’s Matthew Adams wrote an op-ed for the The Hill encouraging Congress to use the Congressional Review (CRA) to remove the CFPB’s payday loan rule that was finalized this past October. The overbearing regulation limits the number of loans that can be taken out at a given time and forces the borrower to disclose their income, borrowing history, and financial obligations. This unnecessarily complicates the process and precludes two-thirds of loans made by lenders.

Adams wrote that the Obama-era rule spelled disaster for low-income Americans who are underbanked as the rule prevents them from getting access to capital when they need it:

“The short-term loans act as a cash advance that are paid back in full at the borrower’s next pay period. Their convenience is essential for consumers as many banks are unwilling to engage in these types of transactions as the little return on fees is not enough to offset compliance costs. While not for everyone, they’re crucial for many who live paycheck to paycheck, and especially for those who have difficulty qualifying for other types of credit.”

Adams noted that the CRA allows Congress to rollback regulations from executive agencies within 60 legislative days:

“The window in which Congress can use the CRA to overturn this rule is expected to expire at the end of this week. With time ticking, it is paramount that Congress moves to relieve American consumers from this unnecessary and heavy-handed regulation.”

To read more of Adams’ op-ed, click on the direct link to The Hill.