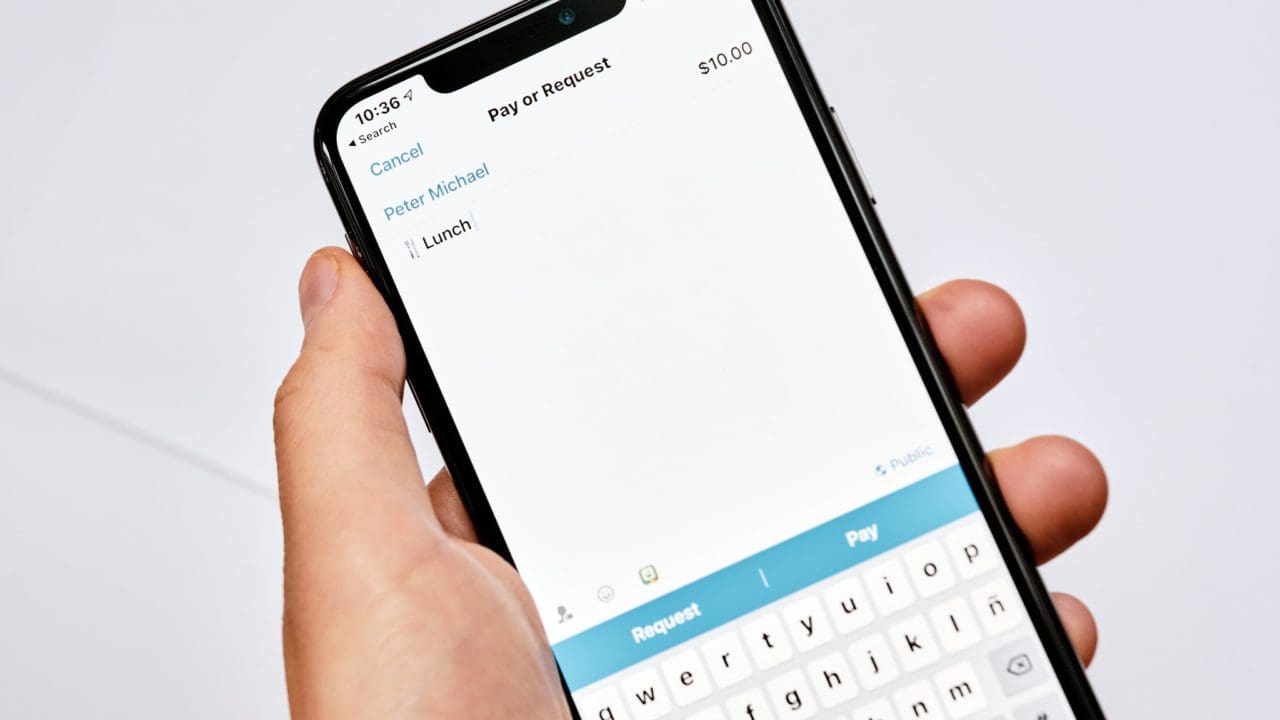

"Venmo" by Focal Foto licensed under CC BY-NC 2.0

"Venmo" by Focal Foto licensed under CC BY-NC 2.0

Americans for Tax Reform supports Sen. Shelley Moore Capito’s (R-Wv.) amendment to the Omnibus spending bill that would delay the Democrats’ IRS 1099-K paperwork nightmare for one year.

Grover Norquist, President of Americans for Tax Reform, issued the following statement in support of the amendment:

“Biden and Democrats thought they could come after Americans’ PayPal and Venmo transactions without anyone noticing. People noticed. This amendment will prevent millions of taxpayers with more than $600 in transactions from third-party vendors from being told by Biden’s IRS that they have a new tax liability this year. Sen. Capito’s amendment will give Republicans an additional year to restore the previous threshold and stop Democrats from targeting Americans’ PayPal and Venmo payments.”

Without congressional action, anyone who was paid more than $600 for selling goods or services using a third-party app, such as Venmo or PayPal, will receive a 1099-K tax form starting in January.

The new $600 threshold is the result of a law changed by Democrats in their $1.9 trillion “stimulus” bill passed in 2021 on entirely partisan lines – with every Republican member of Congress voting against the bill. The prior requirement for 1099-K filings was $20,000 and 200 transactions. It is estimated that more than 20 million Americans could receive a 1099-K next year.

Sen. Capito’s amendment reflects similar legislation she introduced last week along with Rep. Carol Miller (R-Wv.) that was supported by Americans for Tax Reform.

Americans for Tax Reform urges all Senators to support this amendment and prevent millions of Americans from receiving a bill for taxes they don’t owe.