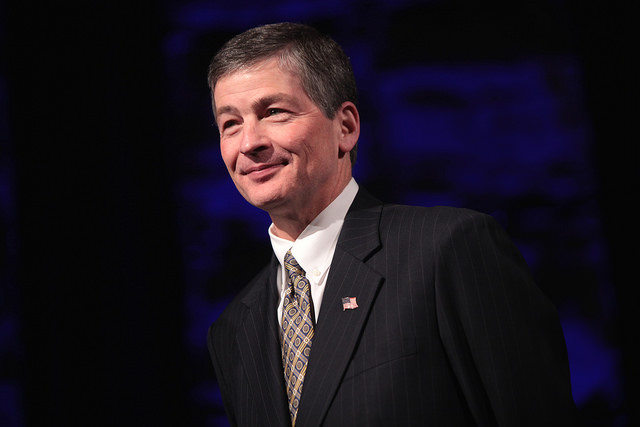

On Tuesday, the House passed the JOBS and Investor Confidence Act, a substitute amendment to Senator Pat Toomey’s S.488. Led in the House by Financial Services Committee Chairman, Jeb Hensarling (R-Texas), in a 403-4 vote, the bipartisan measure will help smaller companies become the Apples of tomorrow, eliminating regulations on capital formation.

Also known as JOBS 3.0, the proposed law is a package of over 30 individual pieces of legislation sponsored by both Republicans and Democrats. By amending U.S. securities laws administered by the Securities and Exchange Commission (SEC), the act builds off of previous JOBS-like packages signed into law in 2012 and 2015 that eased rules on crowd funding and fintech.

Over the past 20 years, restrictions on securities and investments has increased 80%, making it harder for new companies and even more established ones to finance their ventures. With all this red tape, the cost of going public has rose to over $4.2 million on average and can easily take over a year. Because of this, the number of IPOs is nearly half of what it was 20 years ago.

A win for investors and entrepreneurs alike, the act removes barriers in capital markets for startups and reduces rules on initial public offerings. With a more open and steady flow of capital, companies will be able to expand their business presence and better compete in the global economy.

Highlights of the bill include:

- H.R. 79 – Helping Angels Lead Our Startups Act by Rep. Steve Chabot (R-Ohio)

Clarifies the definition of “general solicitation”, fixing an issue in the original definition that barred partnerships and communication between certain startups and angel investors who inject capital into startups in exchange for equity in the business. This allows startups to host demo-days where they exhibit their progress with investors without having to go through burdensome registration with the SEC before they have even offered equity or stock options to interested financiers.

- H.R. 1585 – Fair Investment Opportunities for Professional Experts Act by Rep. David Schweikert (R-Ariz.)

Broadens the definition of an “accredited investor” by expanding it to those with extensive education or job experience in business. Before, those allowed to invest in nonpublic offerings is exclusive to wealthy investors who met a threshold of a $1 million net worth or $200,000 yearly income. By taking into account a person’s expertise instead of just their bank account, this provision creates a larger pool of investors who can engage in financing the capital needs of new firms.

- H.R. 3903 – Encouraging Public Offerings Act by Rep. Ted Budd (R-N.C.)

Expands confidential registration provisions for all businesses, allowing a company to keep information private until they’ve committed to going public. This provides safe harbor for companies considering the benefits of going public, allowing them to test the waters and engage in discussions with investors without being penalized by regulatory agencies during consideration.

- H.R.1343 – Encouraging Employee Ownership Act by Rep. Randy Hultgren (R-Ill.)

Raises the threshold in which a company has to file a confidential disclosure where they outline their risk factors and financial statements from $5 million in stock options to $10 million, with provisions for this to be indexed for inflation. The outdated threshold limited the amount of stock ownership that could be offered to employees and discouraged many from offering any stock or equity at all. These changes increase the ability and ease at which a business can allow worker-ownership in a company.

Upon passage, Chairman Hensarling noted:

“The small businesses of today become the Amazons, Googles and Microsofts of tomorrow. Thanks to the hard work of Members on both sides of the aisle – especially Ranking Member Maxine Waters who worked so strongly and fervently on a bipartisan, cooperative basis – this bill will make a difference for economic growth for all Americans.”

The overwhelming support in the House clearly shows the widespread consensus among legislators from both sides of aisle who realize our Main Street businesses are in desperate need of relief. Americans for Tax Reform looks forward to engaging with the Senate on these measures.