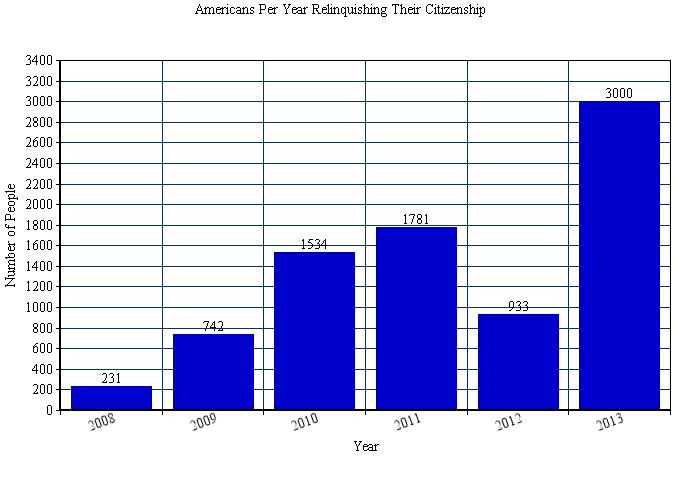

Remember in the November presidential race, when the thought of “4 more years” led to people threatening to move out of the country? Well with the IRS reporting that 3,000 Americans relinquished their citizenship in 2013: the threat was real. These 3,000 no longer Americans set a new record for the amount of people renouncing their citizenship.

While the current administration may be the reason for the abandoning of residency, the more likely reason is the US tax system. Americans living abroad not only have to pay the taxes of the country they are currently living and working in, but also income tax to the US, although some of those living abroad haven’t been to the US in years and have no property there. And if you think this behavior is typical, think again. The United States is the only nation in the Organization for Economic Cooperation and Development that taxes their citizens regardless of location.

IRS gives certain exceptions to those living abroad such as a two month extension to turning in the tax documents; it still creates a hindrance on those filling out the paperwork. One American living and working in England estimates that he spends 100 hours filling out all the paperwork associated with such exceptions. Others don’t have the patience to work out all the tricky language themselves and spend thousands of dollars for other’s to do their taxes for them.

The Government isn’t completely heartless. There are safeguards to try and ensure that this double taxation doesn’t happen. While their goals are noble, things don’t always go as planned. The Foreign Tax Credit (FTC) allows for income taxed in another country to work as a credit towards the American tax. The system is rarely one-for-one perfect and still allows for double taxation to occur. Plus in order to get the tax credit, one has to complete a separate 1116 Form for each type of income. The FTC complicates the already complicated system.

So maybe just renouncing one’s citizenship is the easier option. But wait, even that process isn’t painless! For those who choose to expatriate and are above a certain net worth, they have to pay an exit tax as well. The IRS’ vampire like quality sucks the money out of any Americans who are paying an income tax for income not earned in the United States. Maybe it’s time to look at this tax policy again and keep Americans, American.