Commentary

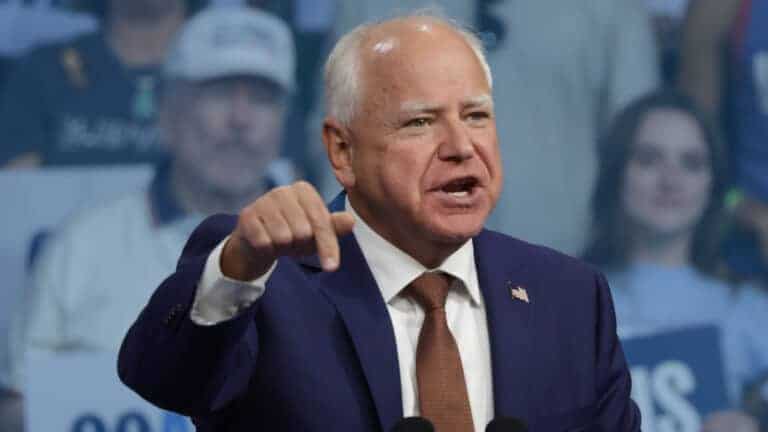

Tax-Hiking Tim Walz Earns an “F” on Fiscal Policy Report Card on America’s Governors

Kamala Harris running mate Tim Walz (D-Minn.) has earned the lowest score on the newly-released 2024 Fiscal Policy Report Card on America’s Governors, compiled…

Trump Tax Cuts Helped McDonald’s Expand Employee Tuition Benefits

And Now Kamala Wants to Repeal TCJA and Raise the Corporate Tax Rate The Trump tax cuts helped McDonald’s expand its employee tuition…

Financial Services

Private Funds Offer a Multitude of Options for Transparency

Regulators continue to wrongly clamor about the so-called “opacity” of loans to private businesses. When regulators, such as the ones that make up the…

Tax-Hiking Kamala Out of Step as Gallup Poll Finds 60% of Independents Say Taxes Are Too High

Trade

Italy and France Push for DST Hike on U.S. Business

Labor, Tax Reform

Kamala’s “Opportunity Economy” Is Anything But

About Us

Has Your Elected Official Signed the Pledge?

No one in modern times has fought harder to shrink the state than the founder of the group Americans for Tax Reform.

One of the most influential figures in the history of the U.S. tax code and the U.S. budget, a consistent and provocative voice for less of each.

Since creating Americans for Tax Reform at Ronald Reagan’s behest back in 1985, Norquist has been responsible more than anyone else for rewriting the dogma of the Republican Party.

There's been no organization in our country who's kept the issue of high taxes and IRS abuse more in the public eye than ATR.

The high priest of Republican tax-cutting

Featured Links

About Grover

“Hands down the most powerful tax advocate in Washington.” – The Hill

Coalition Meetings

"The Grand Central Station of the conservative movement." – John Fund

Featured Letters

Financial Services

ATR Organizes Coalition Letter in Response to FDIC’s RFI on Deposits

Healthcare

ATR Releases Letter in Support of the Health Out-of-Pocket Expense (HOPE) Act

Labor

ATR Supports the “Union Members Right to Know Act”

Policy Areas

-

Tax Reform

Tax Reform

-

Spending & Regulatory Reform

Spending & Regulatory Reform

-

Healthcare

Healthcare

-

Tech & Telecom

Tech & Telecom

-

Energy

Energy

-

Labor

Labor

-

Property Rights

Property Rights

-

Financial Services

Financial Services

Join ATR

Our movement is growing. If you oppose higher taxes, join the fight! Sign up today!