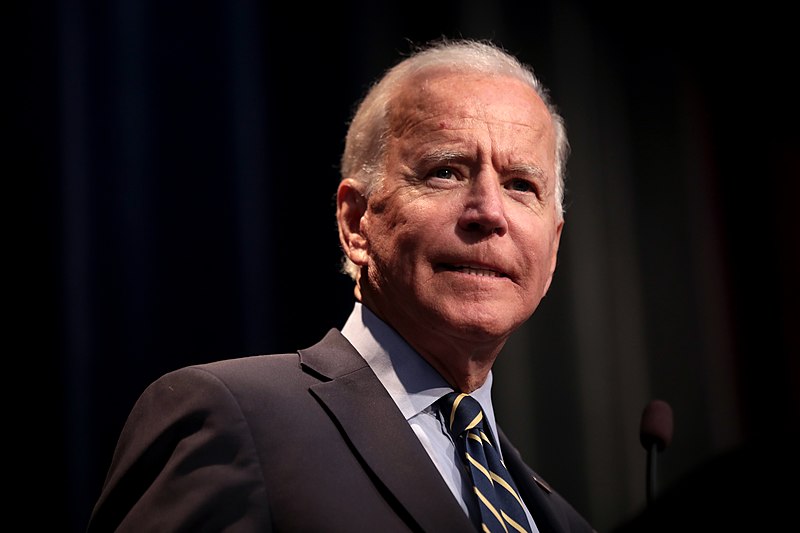

"Joe Biden" By Gage Skidmore licensed under CC BY-SA 2.0. https://commons.wikimedia.org/wiki/File:Joe_Biden_(48651180272).jpg

"Joe Biden" By Gage Skidmore licensed under CC BY-SA 2.0. https://commons.wikimedia.org/wiki/File:Joe_Biden_(48651180272).jpg

If the Democrats’ tax-and-spend reconciliation bill is enacted, the average top tax rate on personal income would rise to 57.4 percent, according to the Tax Foundation.

This would give the U.S. the highest tax rate in the developed world, and stick all 50 states with a combined federal-state tax rate higher than 50 percent.

The combined federal and state top marginal income tax rates for each state under the Democrat bill are listed below. Please visit the Tax Foundation website for a handy map of the below rates compiled by Alex Durante and William McBride:

New York: 66.2%

California: 64.7%

New Jersey: 63.2%

Hawaii: 62.4%

Washington, DC: 62.2%

Oregon: 62%

Minnesota: 61.3%

Maryland: 60.4%

Vermont: 60.2%

Kansas: 59.6%

Delaware: 59.3%

Ohio: 59.1%

Wisconsin: 59.1%

Kentucky: 58.9%

Iowa: 58.6%

Maine: 58.6%

Connecticut: 58.4%

South Carolina 58.4%

Pennsylvania: 58.3%

Montana: 58.2%

Nebraska: 58.2%

Michigan: 58.1%

Idaho: 57.9%

Illinois: 57.9%

West Virginia: 57.9%

Missouri: 57.8%

Indiana: 57.5%

Rhode Island: 57.4%

Arkansas: 57.3%

New Mexico: 57.3%

Georgia: 57.2%

Virginia: 57.2%

North Carolina: 56.7%

Alabama: 56.4%

Massachusetts: 56.4%

Mississippi: 56.4%

New Hampshire: 56.4%

Utah: 56.4%

Oklahoma: 56.2%

Colorado: 56%

Arizona: 55.9%

Louisiana: 55%

North Dakota: 54.3%

Alaska: 51.4%

Florida: 51.4%

Nevada: 51.4%

South Dakota: 51.4%

Tennessee: 51.4%

Texas: 51.4%

Washington: 51.4%

Wyoming: 51.4%

See also:

Dem Plan Will Impose Highest Tax Rate in the Developed World

Dems Still Pushing IRS Bank Snooping Proposal, According to Biden Official

Dem Bill Gives Special Tax Handout for Reporters

Dem Bill Imposes Tax Hikes On Vaping Products, in Violation of Biden Tax Pledge

Dem Bill Includes $900 Handout for “Electric Bicycles”

Dem Bill Imposes Price Controls and 95% Excise Tax on Medical Innovation

Dem Bill Imposes Corporate Tax Hike Which Will be Borne by Working Families