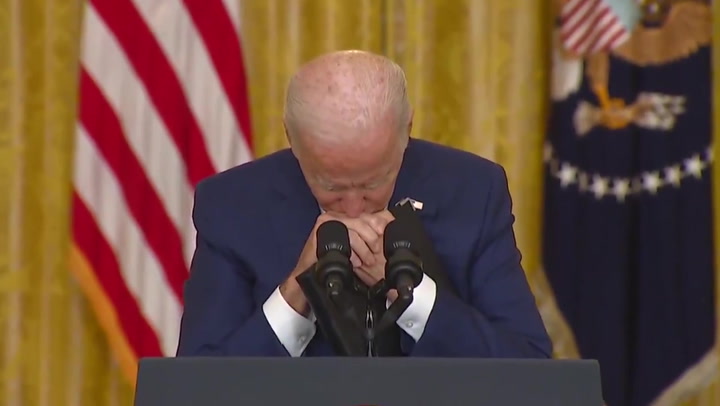

Screen Capture, "Biden Remarks on Kabul," C-SPAN

Screen Capture, "Biden Remarks on Kabul," C-SPAN

President Biden’s first year in office has been disastrous.

He has been responsible for severe inflation and the demise of American energy independence, but has also pushed harmful policies such as supersizing of the IRS, the largest tax hike since 1968, and socialized healthcare.

Below are five things you should know about Biden’s first year in office:

1) Inflation Surged to Its Highest Levels in 40 Years

Inflation has surged across the country due to out-of-control government spending, the administration’s policy of paying Americans not to work, and supply chain issues. In December, the consumer price index increased by 7 percent on an annualized basis, a 40-year high. This marked a steep increase from January 2021 when annual inflation was at a stable 1.4 percent.

Rampant inflation is harming Americans across the country. The average U.S. household spent $3,500 more in 2021 due to inflation, according to a Penn Wharton University of Pennsylvania Budget Model analysis.

Low-income households were disproportionately harmed. In the past year, the bottom 20 percent spent $309 more on food, $761 more on energy, $476 more on shelter, $390 on other commodities, and $224 on other services.

Not only is inflation increasing household costs for consumers, but it could also have long lasting economic damage by eroding purchasing power. This is especially alarming given that wages are decreasing – real average hourly earnings dropped by 2.4 percent on an annualized basis in December.

According to a Gallup poll, 71 percent of low-income households have reported experiencing financial hardship due to rising prices. Of the 71 percent, 28 percent of low-income households say they have experienced “severe hardship” due to rising prices, and 42 percent say they have experienced “moderate hardship.”

Since July, the Biden administration has been insisting this problem would go away. Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen described this inflation as “transitory.” Clearly, those claims have not held up.

2) $3.5 Trillion Tax Hike, The Largest Tax Increase Since 1968

President Biden called for $3.5 trillion in tax increases in his 2022 budget proposal, the largest tax increase since 1968.

In nominal dollars, Biden’s $3.5 trillion tax increase would have been the largest in history. But even when comparing this tax as a percentage of the economy, this tax hike would be the largest in more than 50 years. While Democrats claimed this tax increase would fall on “the rich,” the proposal would have raised taxes on small businesses and working families at a time when they were most vulnerable.

Biden’s proposal included the following harmful tax increases:

- Raising the Federal Corporate Income Tax to 28 Percent. After accounting for state corporate taxes, Biden would give the U.S. a 32 percent corporate rate, a tax rate significantly higher than communist China’s 25 percent tax rate. This tax increase would harm working families, as a significant portion of this tax, about 70 percent, is borne by workers in the form of lower wages and lost jobs. Additionally, the tax would be felt by consumers, as 31 percent of the corporate tax falls on consumers through higher prices.

- Retroactive Tax Increases on Capital Gains and Dividends. President Biden proposed doubling the capital gains tax rate. Under Biden, the average top capital gains rate will be 48.8 percent after state taxes. The retroactive nature of this proposed tax would cause anxiety and uncertainty, ultimately leading to substantial economic damage. This tax hike would result in severe double taxation, would reduce retirement savings, would suppress investment, and could even reduce federal tax revenue.

- Creating a Second Death Tax by Repealing Step-Up in Basis. Biden proposed the creation of a second Death Tax by repealing step-up in basis. This would impose the capital gains tax (which Biden has proposed raising to 43.4 percent) on the unrealized gains of every asset owned by a taxpayer when they die and will be imposed in addition to the existing 40 percent Death Tax. This would create new complexity for many taxpayers, forcing predominantly family-owned businesses to downsize and liquidate assets, leading to fewer jobs, lower wages, and reduced GDP.

- Increasing the Top Income Tax Rate to 39.6 Percent. This tax increase would have hit small business that are organized as sole proprietorships, LLCs, partnerships, and S-corporations. These “pass-through” entities pay taxes through the individual side of the tax code. Of the 26 million businesses in 2014, 95 percent were pass-throughs. Pass-through businesses also account for 55.2 percent, or 65.7 million of all private sector workers. More than half of all pass-through income would have been taxed at this new, higher rate.

- Imposing a 15 Percent Minimum Tax on “Book Income.” This tax increase would create a new minimum tax on American businesses and disallow important, bipartisan credits and deductions that help promote job creation and economic growth.

- Imposing Global Tax Hikes That Will Make American Business Uncompetitive. Biden proposed modifying the Global Intangible Low-Taxed Income (GILTI) regime and imposing a global minimum tax on American businesses of up to 26.25 percent. This proposal was significantly higher than the 15 percent global minimum tax rate that Biden Treasury Secretary Janet Yellen is pushing to get adopted by the G-20 and the OECD. This would impose double taxation on American businesses and make it difficult for them to compete against foreign companies.

3) Proposed Doubling the Size of the IRS, Enabling IRS to Snoop on Americans’ Bank Accounts

Biden proposed $80 billion in additional funding to the IRS, adding a whopping 87,000 new IRS agents – enough to fill Nationals Park twice. Biden’s proposal also included a provision enabling the IRS to track any bank account, credit union account, or third-party payment account (like Venmo, PayPal, and CashApp) exceeding gross inflows and outflows of $600.

In the Democrats’ latest, house-passed version of the reconciliation bill, funding for audits, investigations, and other tax enforcement was 23 times greater than funding for taxpayer education and assistance. Out of nearly $80 billion in new IRS funding, $44.9 billion, more than half, would go directly towards enforcement. The agency would receive a comparatively meager $1.93 billion in funding for taxpayer services, which include things like pre-filing assistance and education, filing and account services, and taxpayer advocacy services.

The bill would result in 1.2 million more annual IRS audits; about half will hit households making less than $75k. This is because, despite the Left’s claims that heightened enforcement would be directed solely towards “the rich,” the wealthy and large corporations already have armies of lawyers and accountants that ensure they are compliant with the tax code.

Instead, the IRS will go after easier targets to find additional tax revenue: small businesses and low- and middle-income individuals.

The agency has a long history of harassing taxpayers, discriminating against political adversaries, violating taxpayer privacy, and incompetence.

The administration’s proposed reporting regime would be a radical violation of privacy, would unleash the IRS’s harassment on virtually every American, and would disproportionately hurt low- and middle-income Americans.

4) Assault on American Energy Development

In the past year, President Biden president signed an executive order banning new drilling leases on federal lands, pursued more than $20 billion in new energy taxes on oil and natural gas production, and vetoed permitting for the Keystone XL pipeline here at home. At the same time, his administration lobbied Congress to oppose sanctions on the Russian Nord Stream 2 pipeline.

After one year of President Biden’s failed presidency, Americans now face the highest gas prices since 2014, surging home-electricity prices, and increased reliance on oil from adversarial nations.

President Biden’s decision to cancel the Keystone XL pipeline had several negative impacts on jobs, energy, and geopolitics. For starters, stopping the project killed about 11,000 jobs in 2021, including the thousands of construction jobs for rural and Indigenous communities the pipeline was on track to create. Additionally, canceling the pipeline ultimately damaged a more efficient, environmentally friendly way to transporting oil. In fact, Keystone XL had committed to the pipeline being fully powered by renewable energy. Importantly, Biden’s policy also cheated Americans out of cheaper, more accessible energy. If completed, the Keystone XL Pipeline would carry 830,000 barrels of oil from Canada through multiple states, where it would eventually reach Texas oil refineries, delivering savings to American families. Finally, killing the pipeline wasted billions of dollars in investments. TC Energy Corporation estimated an investment of more than $1.7 billion into communities, including $100 million in new property tax revenue and thousands of new middle-class jobs for both low and high-skilled workers.

In addition to killing the pipeline, the Biden administration also attempted to issue a ban on new leases to drill for oil and gas on public lands – an effective fracking ban on federal lands. Thankfully, a federal judge blocked this order from going into effect. If it had, it would have empowered foreign adversaries, like Russia, dwindled Americans’ access to energy, and increased energy costs at a time when gasoline prices have already skyrocketed by 49.6 percent.

The Democrats’ multi-trillion-dollar tax and spend bill, which Biden spent the year championing, included an $8 billion energy tax on methane from natural gas production and a $13 billion tax on crude oil, taxes that would be paid by American households in the form of higher energy bills.

Under the Biden Administration, Russia is now supplying more oil to the U.S. than any other foreign producer besides Canada. The Biden Administration went as far as lobbying Congress to vote against sanctions on Russia’s Nord Stream 2 pipeline, sanctions that were supported by 55 Senators including 6 Democrats.

President Biden’s blows to the American energy sector hurts our energy independence and empowers foreign adversaries like Russia. These policies threaten Americans’ access to affordable energy, the U.S. economy, and national security.

5) Pushed for Socialized Healthcare

Biden’s proposal would have imposed drastic price controls on American medical innovation. Specifically, his proposal would have created a 95 percent excise tax on manufacturers who did not agree to socialist price controls. This means that a manufacturer selling a medicine for $100 would owe $95 in tax for every product sold with no allowance for the costs incurred. No deductions would be allowed, and it would be imposed on manufacturers in addition to federal and state income taxes they must pay.

This proposal would have led to 167 to 324 fewer new drugs, according to an issue brief by Tomas J. Philipson and Troy Durie at the University of Chicago. These results are severe, but not surprising. After all, this proposal would arbitrarily set the price of medicines similar to the way other countries with socialized health systems have.

Countries that utilize socialist price controls have lower access to care. For instance, Canadian patients wait an average of 19.8 weeks from referral to treatment. In the UK, at any one time, 4.5 million patients were waiting to see a doctor or receive care. By comparison, 77 percent of Americans are treated within four weeks of referral, while just 6 percent wait more than two months.

Further, Americans have access to far more medicines than other countries. According to research by the Galen Institute, 290 new medical substances were launched worldwide between 2011 and 2018. The U.S. had access to 90 percent of these cures. By comparison, the United Kingdom had access to 60 percent of medicines, Japan had 50 percent, and Canada had just 44 percent.

Additionally, this proposal would have threatened high-paying manufacturing jobs across the country at a time when we were just emerging from the economic wreckage from the pandemic. According to a 2017 study by TEConomy Partners, pharmaceutical manufacturers invest $100 billion in the U.S. economy every year, directly supporting 800,000 jobs including jobs in every state. These jobs are high-paying – the average compensation is $126,000 – more than double the average wage in the U.S. When accounting for indirect and induced jobs, medical innovation supports more than four million jobs.

In trying to be more like foreign countries with socialist policies, Biden was willing to restrict Americans’ access to life-improving and life-saving medicines and threaten much-needed, high-paying American jobs.