Commentary

Tax Reform

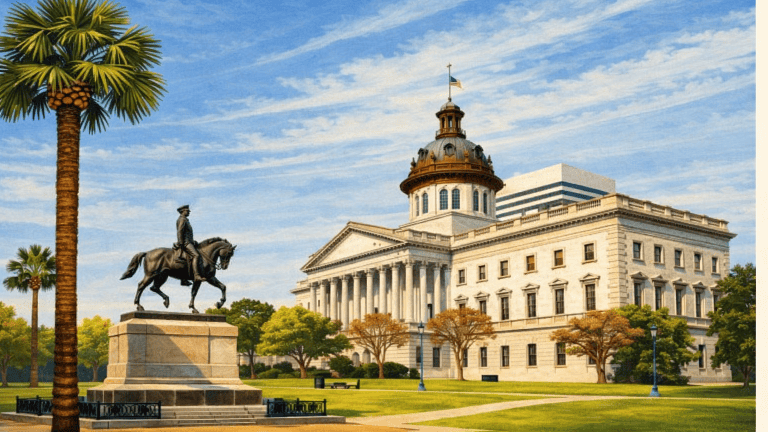

From 6 Percent to 1.99 Percent: South Carolina Set to Lead Nation on Income Tax Relief

It’s set to be a historic week in South Carolina, where the statehouse in Columbia is expected to vote for final passage on…

Tax Reform

Dems to Propose Highest Capital Gains Tax Rate Since 1978

Democrats just cannot stop raising taxes. Their latest proposal would increase the top capital gains tax rate to 35.8% from the current 23.8%. This…

Tax Reform

Nebraska Budget Gap Shouldn’t be Closed with Higher Taxes

Nebraska lawmakers are once again looking for ways to raise more revenue rather than addressing the real issue driving the state’s fiscal challenges: spending. Amendment…

A Government Panel Negotiating Media Rights Would Ruin College Sports

Tax Reform

Trump Can Help Middle Class By Ending the Inflation Tax on Capital Gains

Tax Reform

Union Scheme Would Loot $100 Billion from New York Taxpayers

About Us

Has Your Elected Official Signed the Pledge?

No one in modern times has fought harder to shrink the state than the founder of the group Americans for Tax Reform.

One of the most influential figures in the history of the U.S. tax code and the U.S. budget, a consistent and provocative voice for less of each.

Since creating Americans for Tax Reform at Ronald Reagan’s behest back in 1985, Norquist has been responsible more than anyone else for rewriting the dogma of the Republican Party.

There's been no organization in our country who's kept the issue of high taxes and IRS abuse more in the public eye than ATR.

The high priest of Republican tax-cutting

The Sustainable Budget Project

The Sustainable Budget Project monitors state government spending and tracks which states have or have not enacted sustainable budgets.

Featured Links

About Grover

“Hands down the most powerful tax advocate in Washington.” – The Hill

Coalition Meetings

"The Grand Central Station of the conservative movement." – John Fund

Featured Letters

Tax Reform, Vaping

Testimony, 2026 NY Joint Legislative Budget Hearing on Taxes

Financial Services

Support SB 256, Ensuring Access to Debt Relief Options

Tax Reform

ATR Sends Letter to Virginia Lawmakers Opposing Ban on Sweepstakes Games

Policy Areas

-

Tax Reform

Tax Reform

-

Spending & Regulatory Reform

Spending & Regulatory Reform

-

Healthcare

Healthcare

-

Tech & Telecom

Tech & Telecom

-

Energy

Energy

-

Labor

Labor

-

Property Rights

Property Rights

-

Financial Services

Financial Services