Local governments in CA should avoid the “Netflix tax”

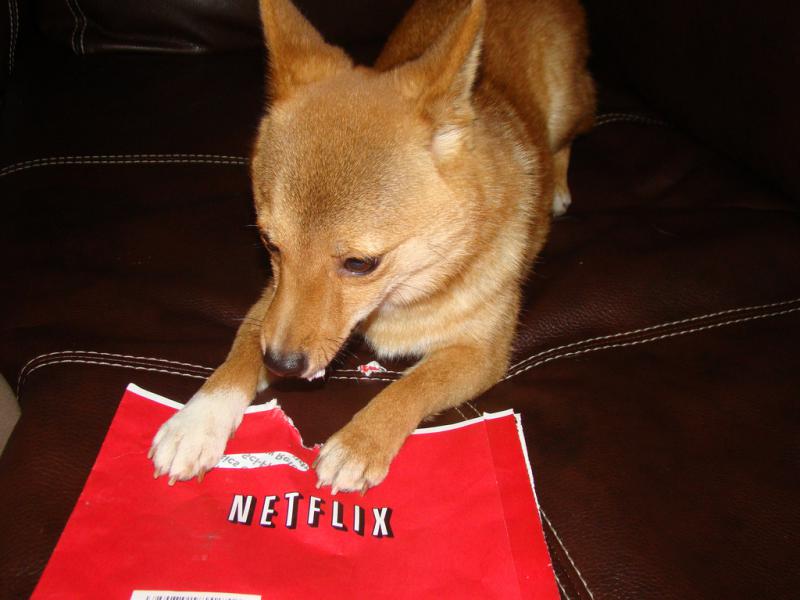

Californians’ monthly Netflix bill may soon go up thanks to money-hungry government officials.

Nearly 50 cities in The Golden State are interested in targeting online movie and TV streamers as a source of revenue through what is commonly known as the “Netflix tax.”

The “Netflix tax,” levied on online streaming subscriptions, is currently in place in just Chicago and Pennsylvania. Chicago’s 9% “amusement tax” was extended to include “cloud services” in July 2015, and Pennsylvania extended its 6 percent sales tax to digital downloads in August 2016.

Nationwide, lawmakers should take note: following the “Netflix tax” trend would be a horrible mistake. “Netflix taxes” are wrong on many levels, including in that they raise constitutional questions.

Indeed, in July of this year, Cook County Circuit Court judge, Anthony Walker, allowed a lawsuit against Chicago’s “cloud tax” to move forward. The lawsuit – filed by the Liberty Justice Center – asserts taxing Internet streaming services violates the commerce clause of the US Constitution, and the Internet Tax Freedom Act.

Unfortunately, concerns with the Netflix tax do not end there. “Netflix taxes” set a dangerous precedent for government to further intrude into our lives.

These days, books, music, and other forms of entertainment can be accessed more conveniently via the Internet. It will not be long before government starts targeting those services as well. This is already the case in Pennsylvania, as it extends its sales tax to downloadable books and music, online games, apps and e-greeting cards.

All of these items have made the lives of Americans more convenient. So, lawmakers should consider the repercussions of implementing such burdensome taxes on innovative businesses.

“Netflix taxes” and the like require businesses to stay on top of numerous taxing jurisdiction across the country. In California alone, for example, the cities considering taxing Netflix, Hulu, and other services would require businesses to collect and remit tax rates ranging from 1-11 percent.

By imposing such complexities on business operations, “Netflix taxes” make it more difficult for companies to succeed. With fewer creative businesses, Americans could have less access to technology that makes life easier.

And more immediately, hardworking Americans have already been dealt Obamacare’s 20 new or higher taxes over the last seven years. Many of them would like to come home from a hard day’s work and catch up on their favorite shows online without lawmakers are shaking money out of almost every activity of their lives.