At almost 75,000 pages, the U.S. tax code is one of the world’s most complex and an estimated $168 billion is spent complying with the code each year. The reality is, the vast majority of Americans do not have the expertise to fill out their own returns.

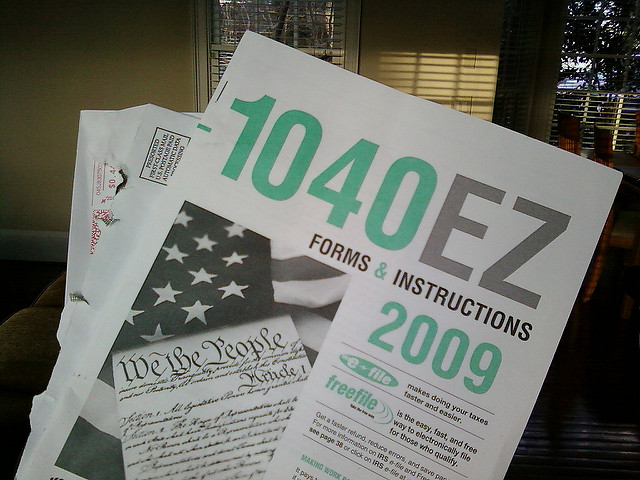

Simplifying this byzantine code should be a priority for lawmakers. There already exists a form for young taxpayers – the 1040EZ, which is used by almost 5 million households each year. The success of this form should be used as a model and expanded.

In fact, one piece of legislation, H.R. 1397, the “Seniors’ Tax Simplification Act,” introduced by Congressman John Fleming, M.D. (R-La.) does just that by creating a form for seniors.

This new tax form simplifies the process for many of the 23 million seniors who file taxes each year and includes information for the most common types of income reported by seniors – interest, dividends, capital gains, Social Security benefits, pension payments, IRA distributions, wages, and unemployment compensation.

Helping seniors across the country should be reason enough to pass this legislation, but by simplifying tax filling, this bill will also help take power away from the out of control IRS.

Over the past year, the agency has complained time and time again that they do not have enough resources to do their job. In reality, the IRS has proven itself to be incapable of responsibly spending taxpayer resources – the agency has a management, not funding problem.

The President’s latest budget request called for giving the IRS more than $1 billion in additional funding through $530 million in direct, discretionary funding and $515 million for a “multi-year program integrity cap adjustment for tax enforcement.”

This is the wrong approach to take.

Instead of pouring billions more to an agency that has failed to properly allocate resources, Congress should continue to push for reforms to the agency like those championed and signed into law last year through the leadership of Ways & Means Oversight Subcommittee Chairman Peter Roskam (R-Ill.).

An easy, common sense way lawmakers can do this is through passing Rep. Fleming’s bipartisan, legislation to make filing taxes easier for 23 million seniors.