The Seattle City Council voted this week to impose a tax on soda and other sugary beverages. Although the excise tax is targeted specifically at sodas, the tax would also affect the price of fruit juice, energy drinks, sweet tea, and even Seattle’s favorite drink: coffee.

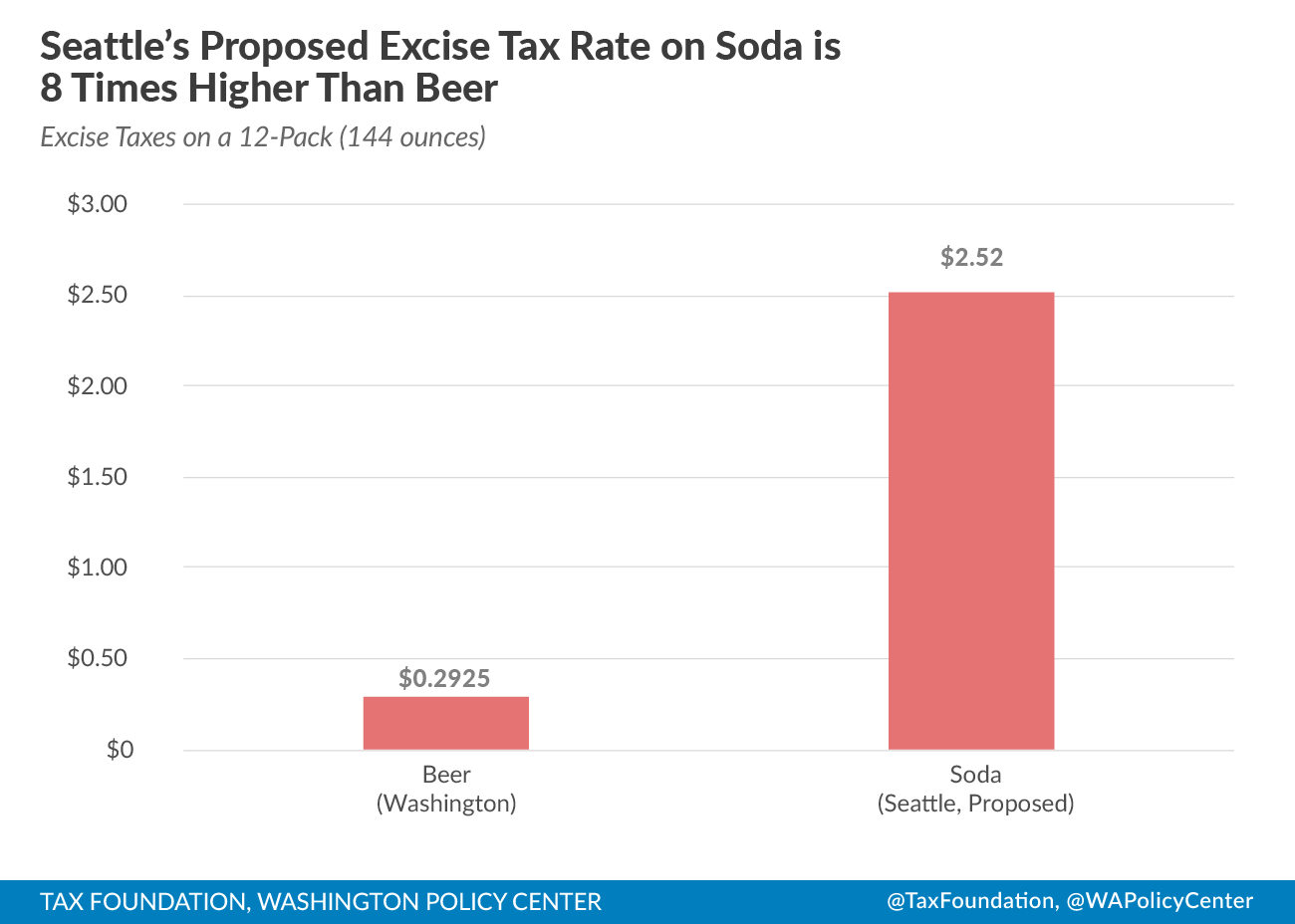

Seattle will collect $0.21 cents for every can of soda sold within city limits, or $5.04 for every case (24 cans). The Tax Foundation notes that at 1.75 cents per ounce, Seattle’s new soda tax is eight times higher than Washington’s tax on beer.

The vote comes as a defeat for the 209 local business owners who petitioned the city council to reject the tax. In a letter, these business owners implored:

Your tax stands to increase wholesale costs by more than 60 percent, which wipes out any money we might make and need to survive. Many of the products covered by this proposed tax are products that contribute considerably to the daily revenue we rely upon to help our employees live in the communities where they work, and allow for an equitable lifestyle for themselves and their families.

If we pass on this regressive tax to our customers, it will dramatically raise the cost of groceries for working families who are already spending a large portion of their paychecks on increased rents, property taxes and car tabs. Under this proposal, the $.99 two liter bottle would increase to $2.35. This is a huge hit to anyone’s budget and ultimately makes Seattle even less affordable, especially for those located in minority communities.

The legislation made unlikely allies of business owners and labor unions, who recognize that beverage taxes kill jobs in convenience stores, restaurants, and other industries. Rick Hicks, the Treasury-Secretary of Teamsters Local 174, writes, “We at the Teamsters cannot and do not support a tax that will put hardworking members of our communities out of a job.”

In 2016, Philadelphia enacted a similar tax, voting to tax soda products at a rate of 1.5 cents per ounce. Although this tax was smaller than Seattle’s tax and did not affect juice, tea, or coffee products, the Philadelphia tax still caused some local businesses to lay off as many as 20% of their employees. Philadelphia business owner Jeff Brown told Bloomberg, “I would describe the impact as nothing less than devastating.”

Seattle Mayor Ed Murray, however, is hopeful rather than fearful that the beverage tax will decrease consumer demand. In order to convince the city council to pass the legislation, Mayor Murray cited a Berkeley study that found soda taxes decrease soda sales by 10%. Apparently, Murray is unconcerned about how decreasing beverage demand will affect small business owners and their employees.

Perhaps the most onerous aspect of the new tax is the city council’s paternalistic attitude toward Seattle residents. By enacting a beverage tax, the city of Seattle has declared, “Citizens don’t know what’s good for themselves, so the government needs to change their behavior.” Certainly, there are healthier options than a Coke, an Arizona iced tea, or even a glass of Sunny D, but drinking these beverages affects only oneself. Along with costing jobs, imposing a beverage tax undermines individual agency by implying that personal nutrition is subject to government censure.

It is difficult to escape the irony of Seattle imposing a tax on Starbucks beverages. As the Tax Foundation’s Scott Drenkard tweeted:

5/ #Seattle trying to tax coffee would be like Italy trying to tax pasta. #sodatax

— Scott Drenkard (@ScottDrenkard) June 2, 2017