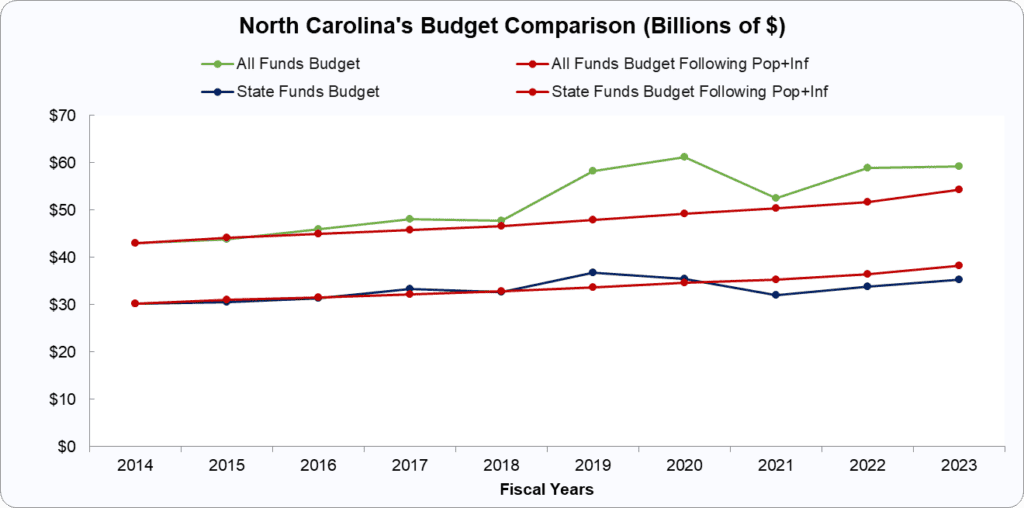

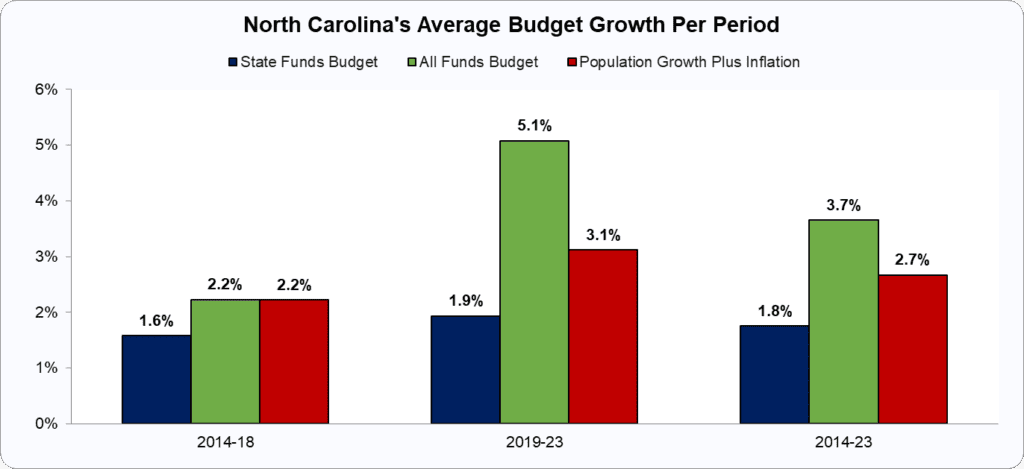

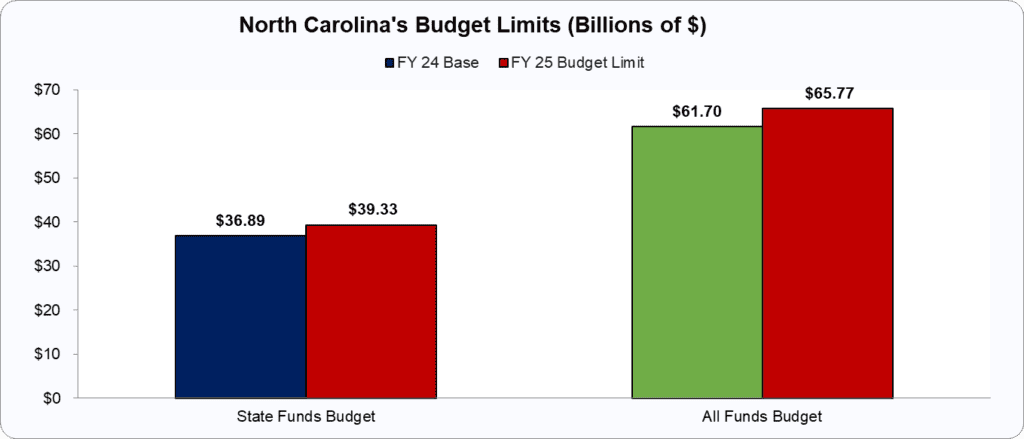

North Carolina’s budget increased cumulatively less than pop+inf in state funds, but more than pop+inf in all funds from 2014-23, meaning state taxes are lower than otherwise, but total taxes are higher than the average taxpayer can afford.

- The 2023 state funds budget is $2.9 billion lower than it would have had spending grown at the rate of population growth plus inflation over the past decade.

- Because the state funds budget grew slower than population growth plus inflation for the last ten years, the state spent and taxed $4.4 billion less than possible.

- The 2023 all funds budget is $4.8 billion higher than it would have been had spending grown at the rate of population growth plus inflation over the past decade.

- Because the all funds budget grew faster than population growth plus inflation over the past decade, the state spent and taxed $40.7 billion too much.