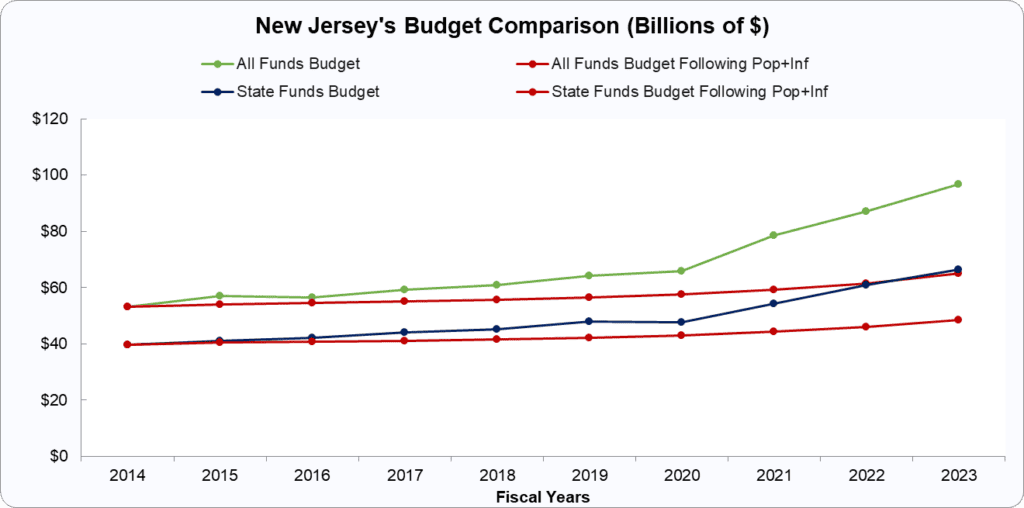

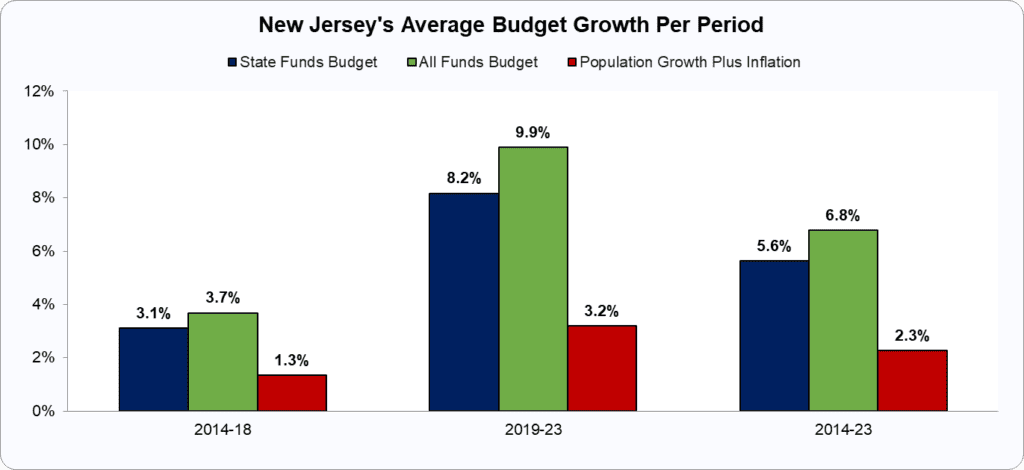

New Jersey’s budget increased cumulatively more than pop+inf in state funds and all funds from 2014-23, meaning taxes are higher than the average taxpayer can afford.

- The 2023 state funds budget is $17.9 billion higher than it would have had spending grown at the rate of population growth plus inflation over the past decade.

- Because the state funds budget grew faster than population growth plus inflation for the last ten years, the state spent and taxed $61.6 billion too much.

- The 2023 all funds budget is $31.8 billion higher than it would have been had spending grown at the rate of population growth plus inflation over the past decade.

- Because the all funds budget grew faster than population growth plus inflation over the past decade, the state spent and taxed $107.6 billion too much.