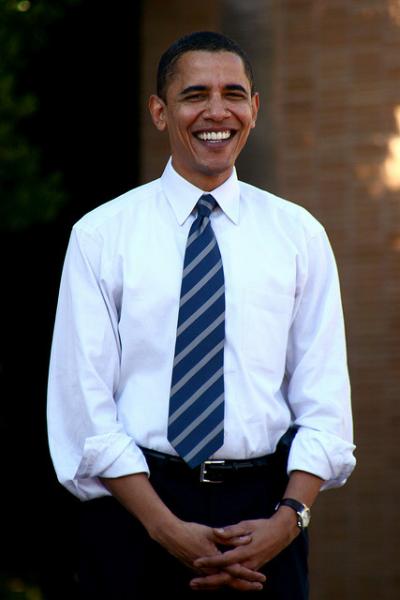

President Obama’s budget calls for a hike in the capital gains and dividends tax rate from 23.8% today (20% plus 3.8% Obamacare surtax) to 28% (including the Obamacare surtax).

The capital gains tax has not been that high since President Clinton signed a rate cut in 1997.

It would represent a massive hike in the rate since Obama took office. When he was sworn in, the rate was 15%. He proposes to nearly double it to 28% in the twilight of his administration.

“Bill Clinton signed Republican legislation reducing the capital gains tax from 28% to 20%. The economy strengthened,” said Grover Norquist, president of Americans for Tax Reform. “During his presidency Barack Obama has increased the capital gains tax from 15% to 20%, then from 20% to 23.8% and now he wants to increase it again to 28%. As a result Obama’s ‘recovery’ has been the weakest since 1960. Obama has a sluggish economy and a very slow learning curve.”

***

See also:

Obama Budget Creates Second Death Tax