In his $152.3 billion state budget proposal, Governor Andrew Cuomo (D-N.Y.) proposed a 10-cent per mL tax on the liquid contained in electronic cigarettes and vapor products. The tax would be imposed on the wholesale level and would apply both to e-liquid that contains nicotine and e-liquid that does not. According to state revenue estimates, the tax would generate $3 million annually.

This reckless tax hike proposal flies in the face of conclusive evidence that vapor products are effective smoking cessation tools that represent no greater than 5 percent of the harms to consumers as traditional combustible tobacco cigarettes. Balancing the state budget on the backs of smokers looking to quit flies in the face of decades of efforts aimed at curbing cigarette use to drive down public health costs.

Currently, six states impose an excise tax on vapor products including North Carolina (5 cents per mL), Louisiana (5 cents per mL), Kansas (20 cents per mL), West Virginia (7.5 cents per mL), Pennsylvania (40% wholesale), and Minnesota (95% wholesale). Beginning April 1, California will also impose a 27.3% wholesale tax on vapor products.

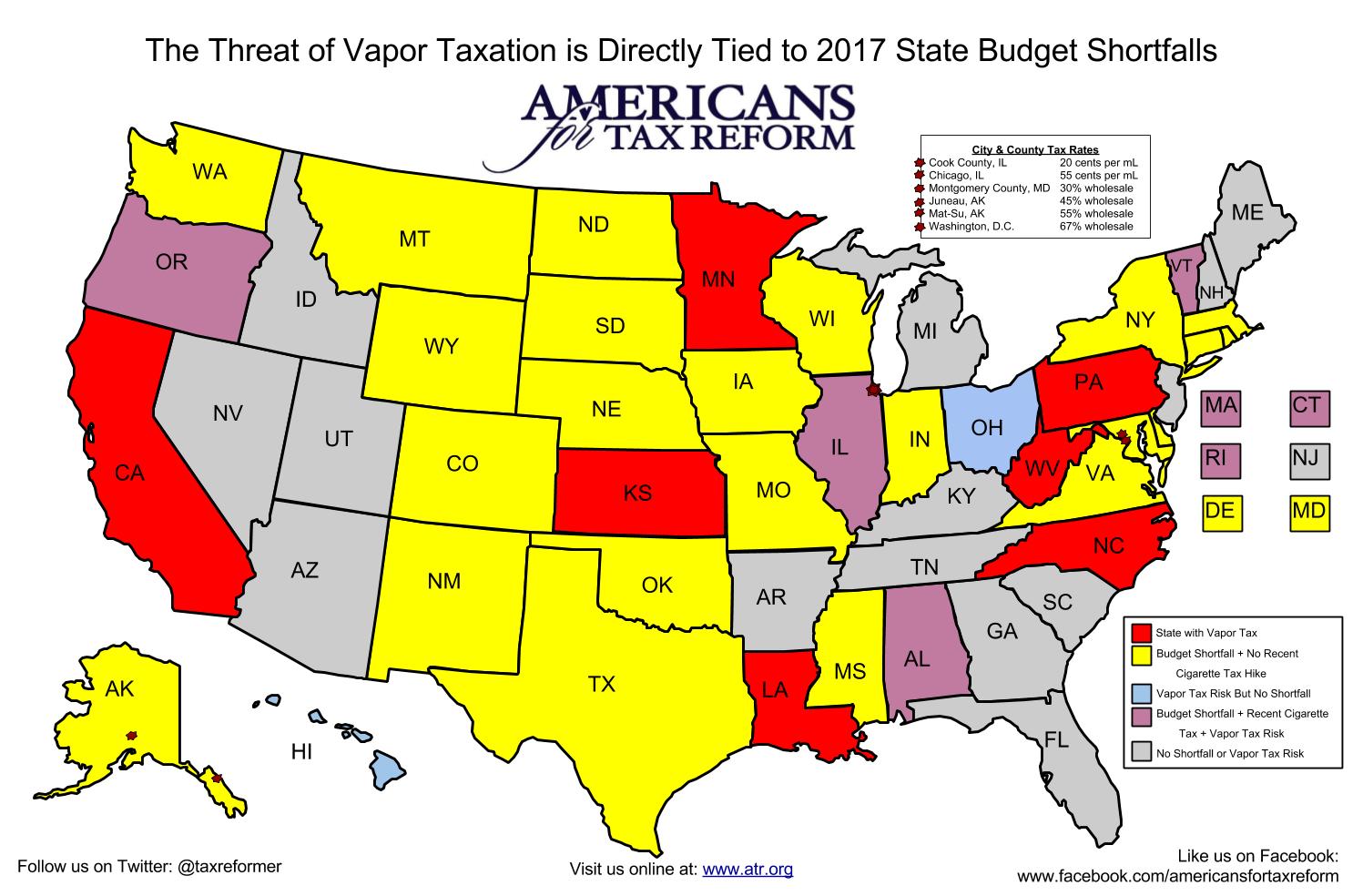

Earlier this month I outlined the possible relationship between state overspending problems like New York’s and possible tax threats to vapor products in the states. That map can be found below and the original piece can be read here. Click the map to enlarge.

Though only a small portion of Cuomo’s large tax hike plans (including an extension of the nearly 9% “temporary” tax surcharge on income over $1 million), the tax on vapor products is among the most punitive. It not only targets smokers, who are some of the most heavily taxed consumers in the United States, but it targets former smokers who have found vapor products as a successful means of quitting smoking. Similar to other nicotine replacement therapies (NRTs), vapor products should remain taxed at the sales tax rate exclusively.

The state’s declining revenue collections from cigarettes may play a role in the increased interest from the governor in taxing vapers. During the current fiscal year, tobacco products generated about $1.3 billion for the state, a figure projected to decrease to roughly $1.2 billion this year and even further in future years. At $4.35 per pack, New York’s state cigarette tax is the highest in that nation. Residents of the Big Apple are hit with another local tax that brings smokes bought there to a per pack tax rate of $5.85.

This high cigarette tax rate has led to the highest rate of cigarette smuggling in the nation. According to an analysis conducted by the nonpartisan Tax Foundation and Mackinac Center for Public Policy, 55.4 percent of cigarettes consumed in the state are smuggled in, which helps consumers avoid paying taxes on the products.

Unlike cigarettes, consumers can purchase vapor products online where taxes are not collected or imposed by the government. This will result in the closing of vape shops across the Empire State, a loss in sales, income, and excise tax revenue, and will harm those seeking a brick and mortar experience in their quit journey.

The legislature should reject this senseless cash grab and focus on spending restraint instead.

Want to keep up to date with news like this? Subscribe to my newsletter, “Vapor News and Views,” by clicking here.