Like clockwork, Congress votes on reauthorizing a set of about 55 temporary tax provisions every year or two. Tax extenders, as they are collectively known, include a broad range of pro-growth tax relief provisions like bonus depreciation and small-business expensing, research and development tax credits and provisions to prevent double taxation.

Congress will inevitably renew these temporary provisions at the last minute like they have time and time again. Doing nothing is not an option, because so many of these provisions are of vital importance for American businesses, families, and the economy.

If that is the case, why not make them permanent?

The reason they have been kept as temporary for so long is so lawmakers can distort the revenue baseline and hide the true cost of extenders when measuring their ten year effect. This means that under current law revenue projections, the revenue baseline artificially projects higher taxes and higher revenue because it assumes extenders will only last through their current extension.

But this manipulation comes at a price. The current system of one or two year extensions wreaks havoc on the ability of businesses to plan ahead and on tax preparation. For this reason alone, Congress should look to make as many extenders permanent as possible – prioritizing the good, pro-growth provisions like business expensing.

Making extenders permanent is also seen as step one for fundamental tax reform, a key goal of fiscal conservatives, because it allows a more accurate revenue target when forecasting feedbacks from changes to the tax code.

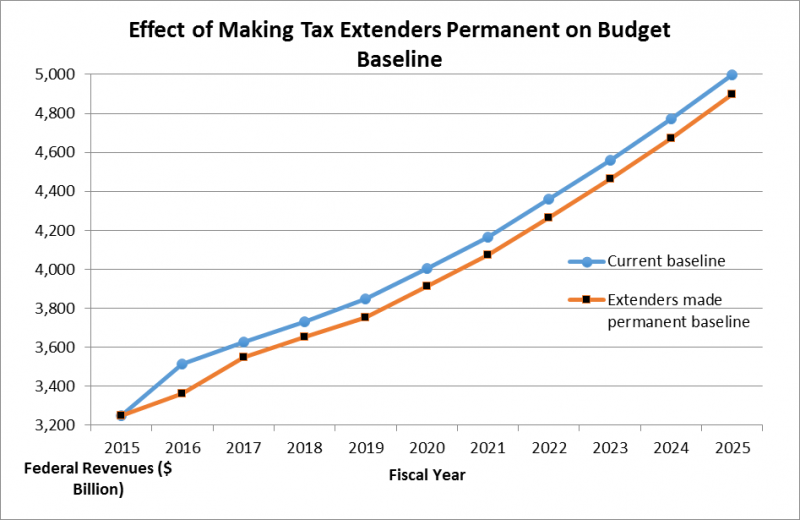

The chart below shows the difference between the current law temporary extenders baseline and the baseline if all tax extenders were made permanent, based on CBO’s latest budget outlook.

While the difference in baselines may visually look small, it is close to $150 billion in tax relief — a significant difference in revenues.

Leaders in Congress have already recognized the importance of permanent extenders to tee of tax reform.

In a recent Wall Street Journal interview, new Ways and Means Chairman Kevin Brady (R-Texas) outlined the case for permanent tax extenders as step one toward pro-growth tax reform: “One, because it creates certainty for the economy. Two, you get a better bang for the buck for the tax provisions. And three, it’s honest scorekeeping. It identifies what truly are permanent parts of the code.”

This sentiment has been echoed in the past by Speaker Paul D. Ryan (R-Wis.), who has said tax reform would be easier with a lower, more accurate revenue target.

The bottom line is that making tax extenders permanent is not only good for taxpayers and businesses, it is also a prerequisite for strong, pro-growth tax reform. There is no reason Congress should not get this done.