As Virginia’s gubernatorial race heats up, Americans for Tax Reform will be examining the policy proposals and records of both Republican Ed Gillespie and Democrat Ralph Northam. Northam, who currently serves as the state’s Lieutenant Governor and previously served in the legislature as a state Senator has a long record of supporting measures that harm taxpayers and businesses alike.

Included below is a list of some of the tax increases Ralph Northam supported during his time as a state Senator and Lt. Governor:

Transportation Tax Hikes

A Six Cent per gallon Tax Increase (SB 6009, 2008)

Increase in Gas Tax (HB 2313, 2013)

Increase Gas Tax in Hampton Roads region (SB 6009, 2008)

Sales Tax Hikes

Increase Sales Tax from Five Percent to 5.25% (SB 6009, 2008)

Increase in Sales Tax by Six Percent (HB 2313, 2013)

Increase sales tax Hampton Roads region (SB 6009, 2008)

Internet Sales Tax (SB 660, 2010)

20% Sales Tax Increase in Hampton Roads region (HB 2313, 2013)

Real Estate Taxes Hikes

Increased Grantors Tax Rate (SB 6009, 2008)

Institute a $5 per night Hotel Room Tax (SB 6009, 2008)

150% Increase in Real Estate Transfer Tax for Hampton Roads region (HB 2313, 2013)

3% Hotel Tax Increase in Hampton Roads region (HB 2313, 2013)

Automotive Tax Hikes

38% Increase in Car Sales Tax (HB 2313, 2013)

Increase Auto Sales Tax by .5% (SB 6009, 2008)

Scholarship Tax Credits

Opposed scholarship tax credits for individuals and corporations (SB 131, 2012)

Health Care

Affordable Care Act (Obamacare) (RGA, Northam for Governor)

Individual Mandate Non-Compliance Tax

Medicine Cabinet Tax on HSAs and FSAs

Flexible Spending Account Tax

Chronic Care Tax

HSA Withdrawal Tax Hike

Ten Percent Excise Tax on Indoor Tanning

“Cadillac Tax” – Excise Tax on Comprehensive Health Insurance Plans

Health Insurance Tax

Employer Mandate Tax

Surtax on Investment Income

Payroll Tax Hike

Tax on Medical Device Manufacturers

Tax on Prescription Medicine

Codification of the “economic substance doctrine”

Elimination of Deduction for Retiree Prescription Drug Coverage

$500,000 Annual Executive Compensation Limit for Health Insurance Executives

In addition to tax increases, Ralph Northam has opposed codifying the protection of employees against forced unionization in the Virginia Constitution. During his time as Lt. Gov., Northam campaigned against a ballot measure that would add Right to Work to Virginia’s constitution through an amendment. Since Northam has touted his opposition to this legislation. While Virginia has been a “Right to Work” state since 1947, adding the measure to the state’s constitution would have further strengthened worker protections against forced unionization in the future.

Despite labeling himself as one throughout his political career, it is clear that Ralph Northam is anything but a fiscal conservative. Northam’s continued support for economically destructive tax hikes, expansion of government, and anti-small business measures makes him anything but conservative. Ralph Northam is not a friend of taxpayers, and Virginia voters should remember that this November on Election Day.

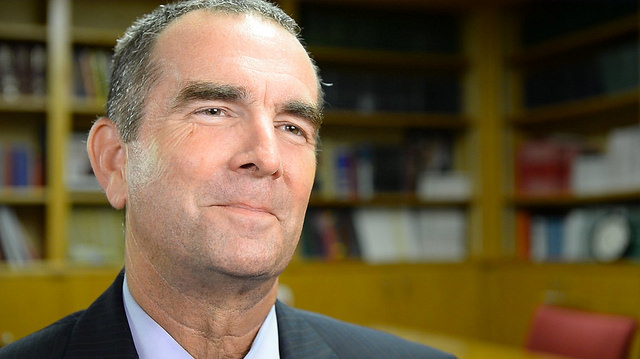

Photo Credit: VCU CNS