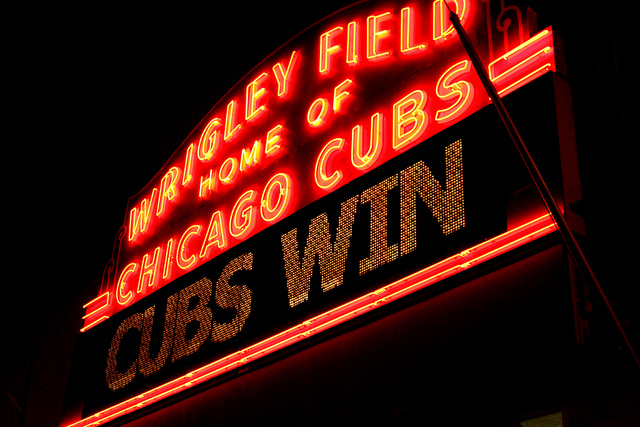

The Cubs have just won the World Series! Well that hasn’t been said in a long time, 108 years to be exact. 108 years ago the Ottoman Empire existed, there was no such thing as sliced bread, and there were only 46 states in the US. A lot has changed in 108 years. In 1908 the government didn’t find liberty in taxing Americans for almost everything they bought, money they earned, and money they saved for their children. Let’s look back and see what the government has been up to since 1908.

The last time the Cubs won a World Series in 1908:

· A federal income tax was invalidated and ruled unconstitutional by a decision from the Supreme Court in 1894. On July 2, 1909 the 16th amendment to the United States Constitution was passed and was ratified in 191 creating a federal income tax. In 1909, the highest income tax bracket was 7% . Today, it is a whopping 39.6%.

· No Death Tax existed. The Revenue Act of 1916 created an Estate Tax that contains many features of our modern day system. The Tax Reform Act of 1976 created a unified gift and estate tax stating, “single, graduated rate of tax imposed on both lifetime gifts and testamentary dispositions.” 14 states, and DC, impose and estate tax with the highest rate at 20%.

· No state sales tax existed. In 1921 West Virginia became the first state to enact a sales tax opening the gates for 45 more states, and DC, to create a sales tax. The state sales tax in the US ranges from 1-10%.

While the Cubs haven’t had many wins since 1908, the government has. Looking back 108 years has taught us a lesson; taxes don’t shrink. The government keeps expanding and putting the burden of their mistakes on the taxpayers. For the government, the expansion of taxes has been the best thing since sliced bread.