Despite the objections of some – perhaps biased – observers, the Kansas tax cuts appear to be working. Christopher Ingram at The Washington Post’s Wonkblog declared the failure of the Kansas tax cuts based on a single metric – when compared to average US job growth, Kansas job growth has lagged. It should also be of note that Ingram bases part of his criticism off of a Center for Budget and Policy Priorities (CBPP) study, citing them as a “nonpartisan think tank” – the The New York Times has called CBPP “left-leaning”, The Washington Post has called them “progressive”, and Time Magazine has called them “liberal” as has the National Journal.

To really understand the success of the Kansas tax cuts, one would need to look not at a US aggregate of unemployment data, but at the Kansas-Missouri border where two states share a split metro area and for all-intents-and-purposes a porous boundary.

- Bureau of Labor Statistics data details a significantly better trend for Kansas as opposed to Missouri following the passage of the first round of tax cuts in 2012. In the year 2012, both Missouri and Kansas saw significant drops in state unemployment rates. Kansas began in January, 2012 with a rate of 6.1% and finished out the year at 5.4%. Missouri began 2012 at 7.5% and finished out the year at 6.7%. However, in 2013 after the 2012 Kansas tax cuts had kicked in, the two states diverged. Kansas continued to reduce their unemployment rate, dropping from 5.5% in January 2013 to 4.9% in December. Missouri, on the other hand, saw their rate fluctuate – beginning the year at 6.5%, then climbing to 7.2% in August of 2013 before finally seeing a drastic drop in December to 5.9% (partially due to holiday hires in the retail sector – note: this applies to Kansas as well). The preliminary rates for 2014 show Kansas holding steady at 4.8% (comparable to nearby Iowa holding steady at 4.3/4.4%, Nebraska at 3.6%, and Colorado around 6%). Missouri, unlike Kansas, has seen their unemployment rate increase – moving from 6% in January of 2014 to 6.6% in May.

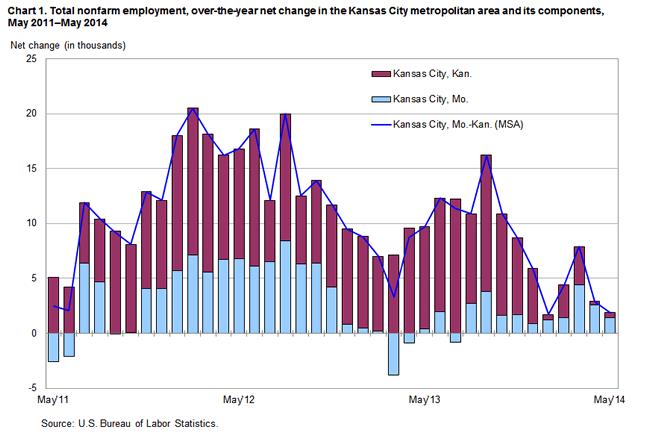

- An examination of the non-farm employment data provided by the BLS for the Kansas City Metro-Area, specifically, shows a drastic shift of employment growth from the Missouri side to the Kansas side:

The greatest job growth in the Kansas City metro-area has been generated in Kansas, not in Missouri. It is arguable that the 2012 spike was caused by businesses anticipating a better tax climate in Kansas after the 2012 tax cuts.

From a broader regional view, Kansas still remains a relatively high tax state with a top rate of 4.9% – at least until further income tax rate reductions kick in. Colorado, by comparison has a flat rate of 4.63%. Prior to 2013, Kansas was higher – at 6.3% – than Missouri which has a top rate of 6%. Additionally, the current 4.9% rate is relatively on par with Oklahoma which has a top rate of 5.25% – though, again, prior to 2013 the top rate in Kansas was higher.

While the state budget shortfall has made news, there is strong evidence that most of the shortfall can be traced to federal tax policy changes and not state changes – though Josh Barro writing at The New York Times disagrees. CBO data, that I have detailed here, points to a shift in capital gains filings out of 2013 and into the end of 2012 to avoid President Obama’s “Fiscal Cliff” which resulted in an increase in the federal capital gains tax. This left many states – from California to Connecticut – with shortfalls and downward revisions in revenue projections this past tax year. Long story short, other states who have not enacted tax reforms like Kansas are also struggling with the accuracy of their revenue projections this year.

One final note, Kansas is required by law to have a balanced budget, unlike the Federal government. A significant budget surplus this year will alleviate much of the concern with the lower than expected revenue collections. Opponents of tax reform and spending interests want to try and write an early obituary for the Kansas tax reform. Unfortunately for them, the tax cuts are working and will continue to improve the Kansas economy for years to come.