Today Hillary Clinton criticized Donald Trump’s proposal to reduce the corporate income tax rate. In a Monday speech at the Detroit Economic Club, Trump reaffirmed his commitment to lowering taxes for ALL businesses. This is welcome news because America has the highest tax rates for businesses in the developed world. Lowering business taxes to a globally competitive rate will allow our businesses to compete against foreign competitors and put a stop to corporate inversions and foreign acquisitions of American assets.

The Trump tax plan calls for lowering the tax rate for all businesses to 15 percent. A rate reduction is desperately needed. The current corporate income tax rate is 39 percent (federal rate of 35 percent plus the average state rate of 4 percent) while the top federal rate for businesses organized as pass-through entities is 39.6 percent.

In contrast, Hillary has suggested there is no need to lower the corporate rate. Clinton advisor Neera Tanden recently suggested that Hillary would oppose any effort to lower the corporate income tax rate because “the U.S. has been doing pretty well when it comes to competitiveness.” This position puts Hillary far to the left, far outside the mainstream of economic thought.

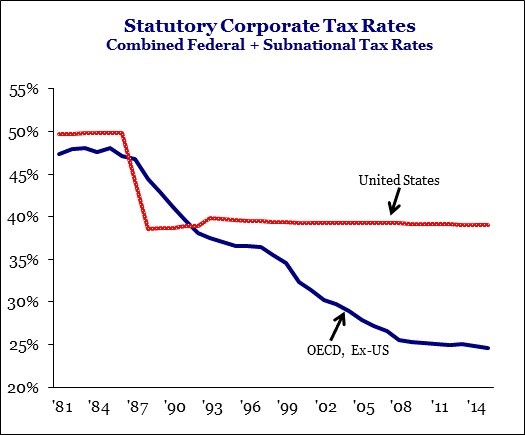

Chart by Strategas Research Partners using Tax Foundation and OECD data

Rather than reduce the extremely high, uncompetitive corporate tax rate, Clinton has proposed an “exit tax.” The term “exit tax” is used by the campaign itself. Her campaign document describing this proposal says it will impose an $80 billion tax increase.

The Clinton campaign has called for at least $1 trillion in higher taxes including a $275 billion tax hike through unspecified “business tax reform.” Her campaign has failed to release specific details on these proposals so the true Clinton net tax hike figure is likely much higher than $1 trillion

Clinton’s refusal to acknowledge and address America’s high business tax rates will ensure that America’s competitiveness problem remains unresolved.

As shown in the chart above, America’s corporate income tax rate is close to 15 percent higher than the average in the developed world. The tax rate has barely changed since tax reform was passed 30 years ago in 1986. At the time, we lowered our rate to 39 percent – below the developed average of 44 percent. Since then, other countries have cut their rates aggressively.

31 of the 34 OECD countries have reduced their corporate rates since 2000. Only the U.S. and Chile have higher corporate tax rates than they did in 2000. Our high rate makes it difficult, if not impossible for our businesses to compete with competitors that have much lower rates like Canada (26.3 percent), the United Kingdom (20 percent), and Ireland (12.5 percent).

This inaction has resulted in close to 50 American businesses leaving the country through an inversion in the past decade, according to data compiled by Democrats on the Ways and Means Committee. America has also lost an additional $179 billion worth of assets through acquisitions by foreign competitors, according to a report by Ernst and Young.

Clearly there is a need to reduce business taxes, both to reduce the burden on American businesses and to allow them to compete with foreign competitors. While the Trump tax plan calls for across the board business tax reductions, the Clinton plan would only make the tax code more complex and burdensome for American businesses.