Now that Ohio primary season is over, legislators are free to begin work on the hot button issue of the 2014 legislative session: tax reform. Governor John Kasich’s proposal defies the basic tenants of conservative tax reform. It redistributes the tax burden on the backs of low-income Ohioans while taking aim at the energy industry, which is creating thousands of jobs in eastern Ohio.

The governor’s proposal certainly starts off on the right foot. By further reducing the income tax by 8.5 percent and raising the personal exemption, taxpayers would get to keep more than $2.6 billion of their hard-earned income over the next three years. Unfortunately, Kasich’s complete proposal engages in tax shifting that raises taxes on tobacco, energy, and small businesses.

As if President Obama’s war on energy producers wasn’t enough, Governor Kasich’s first tax increase targets Ohio oil and gas with higher frack taxes. The industry supports thousands of jobs in Ohio, both directly and indirectly. The shale energy revolution will generate billions of dollars in economic activity, thousands more jobs, and in turn more income tax and sales tax revenue for the state without higher tax rates.

To suggest as OSU professor Mark Partridge did that a $847 million tax hike would be “inconsequential” defies common sense and logic. The governor’s proposed severance tax would absolutely discourage investment in this sector of the economy.

Gov. Kasich also goes after low-income consumers with a proposed 60-cent increase in the cigarette tax. As a percentage of income, low-income individuals spend seven times more on cigarettes than wealthy ones. That¹s why tobacco taxes are extremely regressive, disproportionately burdening the poorest individuals the most.

Even more, raising cigarette taxes does not necessarily mean more revenue for the state. In May of 2012 when Illinois raised the cigarette tax by $1-per-pack, the tax delivered $138 million less than expected. Before that, of the 57 tobacco tax increases enacted by states between 2003 and 2008, only 16 met initial revenue projections.

There’s also a negative impact on small businesses. They often lose tens of thousands of dollars as a direct result as consumers purchasing tobacco across state lines. Convenience stores, for example, rely on cigarettes and other tobacco products for more than 40 percent of all store revenue. To avoid higher tobacco taxes, consumers have constantly demonstrated that they are willing to purchase the products in less expensive markets.

Anti-smoking activists and public health advocates should be concerned about the next target of Gov. Kasich’s tax hikes: e-cigarettes and vapor products. His proposal would raise taxes by more than 700 percent on these products. This would cripple brick and mortar vapor shops and do irreparable damage to small businesses struggling to make ends meet.

Taking aim at e-cigarettes with higher taxes works against efforts to reduce the harm associated with smoking. A number of studies have shown that electronic cigarettes can improve health and prevent disease. By choosing to “vape” e-cigarettes, consumers get their nicotine fix without the combustion and smoke, which are responsible for many of the negative health effects of tobacco cigarettes.

Higher taxes on innovative products that reduce smoking and people¹s dependence on tobacco are misguided and will impede proven harm reduction methods. That is probably why bills to raise taxes on these products have stalled in the legislature.

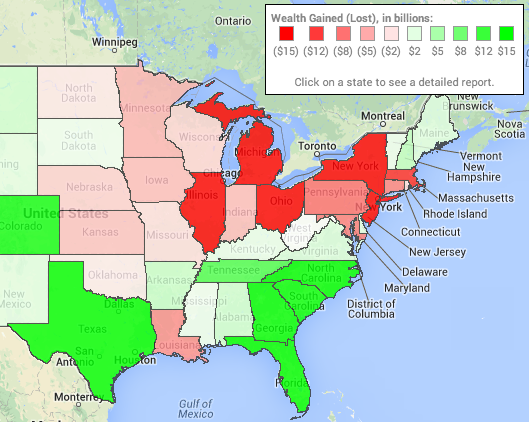

Between 1992-2011, Ohio lost more than 390,000 people and $19.6 billion in annual adjusted gross income to business and tax friendly states like Florida, Tennessee, and Texas, all states that do not tax income. That’s why lowering and eventually eliminating the income tax is a goal that governors and legislatures nationwide should work towards. There are, however, ways to accomplish this without needlessly targeting innovative products and industries with higher taxes, especially when higher taxes on those things may not generate more revenue for state coffers.

There are a number of states getting tax reform right, North Carolina and Kansas most recently. Governor Kasich’s proposal does not simplify the tax code – the jungle of Ohio¹s chaotic municipal income tax system remains intact – it instead engages in little more than tax shifting.

Tax reform in Ohio should include a reduction of the number of income tax brackets – there are currently nine – and address the out of control and burdensome municipal income tax regime. It absolutely should not pick winners and losers. Pro-growth tax reform takes a willingness to make tough choices, which Governor Kasich’s proposals fail to do.