The 18th century English writer Dr. Samuel Johnson defined excise taxes as “A hateful tax levied upon commodities, and adjudged not by the common judges of property, but wretches hired by those to whom excise is paid.” In the midst of ongoing debates about tax hikes on tobacco cigarettes, liquor, soda, and vapor products, this seems relevant.

Over the last two years, a new target for the public health wretches has emerged, replacing the long-standing number one target of sin taxes aimed at extracting money from low-income consumers. Electronic cigarettes and vapor products are disruptive, innovative, technology products that are accomplishing what the public health community never could – they’re getting people to quit smoking. Some estimates and national surveys suggest that more than six million people in the United States are daily vapers. This comes at a time when cigarette smoking rates are among the lowest they’ve been in years.

In 2014, 15 states considered proposals to tax vapor products like tobacco products with taxes as high as 95 percent. Alternative proposals, like those on the books in North Carolina, subject vapor products to a smaller tax of $.05 per mL of liquid nicotine. A proposal in Arkansas this year would do the same thing.

A recent history of cigarette tax increases should provide some insight into the future of e-cigarette and vapor product taxes, should more states add excise taxes to the books with regards to the products. As we at ATR have noted before, e-cigarettes should not be taxed like tobacco products. Currently, only Minnesota and North Carolina impose sin taxes on the products – with Minnesota taxing them at 95 percent, up 75 percent from two years ago.

But what about smaller taxes, less than 75, 95, or 50 percent? A look at cigarette tax hikes since 2000 may shed light on the threat of accepting such proposals.

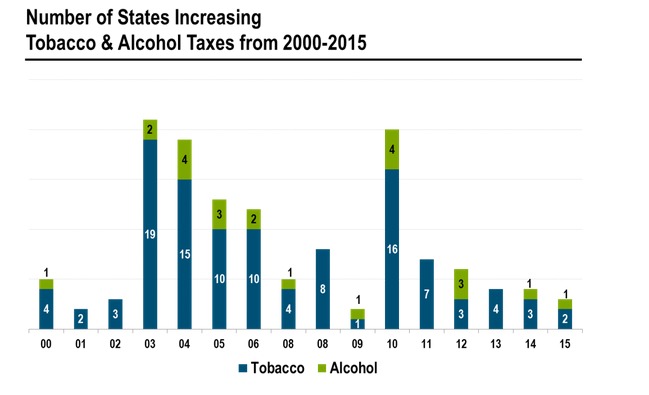

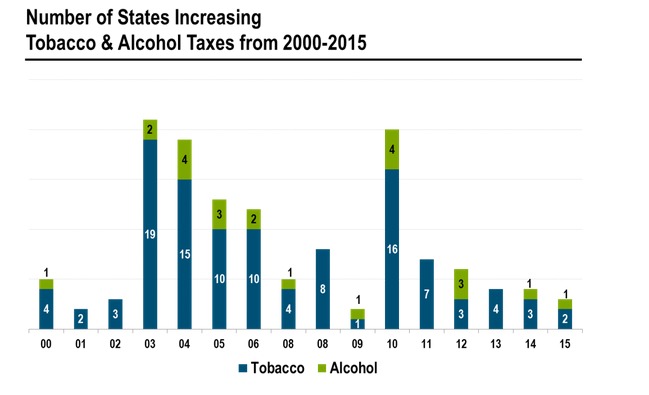

The average excise tax on a pack of cigarettes in 1999 was 38.9 cents. Today, the current average excise tax is $1.54 per pack. States have increased tobacco taxes about five times as often as they have raised alcohol taxes between 2000 and 2015, with 111 increases over that time according to the National Association of State Budget Officers.

Source: NASBO

Click here for a list of every statewide cigarette tax hike between 2000 and 2015.

As you can see, the years during and immediately following a recession saw the largest number of cigarette tax increases. In 2003, 19 states increased tobacco taxes; 15 in 2004 and 16 in 2010.

What does any of this have to do with e-cigarettes and vapor products? Many state legislators have begun to realize that their increasing reliance on tobacco revenue to fund a wide range of programs may have been a bad bet. With declining cigarette revenue, states stand to lose (and are) billions of dollars in tax dollars. One would hope this could be celebrated, as less and less people are smoking but many legislators are clearly more concerned with compensating for this declining and lost revenue. And not in public health.

E-cigarettes are the new target. Click here to view a map of the tax threats in the states.

The rise in cigarette excise taxes over the past 15 years should provide a warning to those who think once a tax is on the books in a state, there won’t be efforts to raise it slowly over time. Minnesota’s tax on e-cigarettes began at 75 percent and is now 95 percent. Some taxes are far more damaging than others. But the fact remains, it is much easier to fend off new taxes than to fight higher taxes. Just ask smokers.