Four million American taxpayers will be forced to pay the Obamacare individual mandate non-compliance tax in 2016, according to a newly released analysis by the Congressional Budget Office.

The report, titled Payments of Penalties for Being Uninsured Under the Affordable Care Act: 2014 Update, includes a gingerly-worded reminder that Americans will be liable for the tax as part of their annual tax-filing process:

“Among the uninsured people subject to the penalty, many are expected to voluntarily report on their tax returns that they are uninsured and to pay the amount owed.”

The CBO data also show that the overwhelming majority of those liable for the tax are part of low-to-middle income households, a clear violation of President Obama’s promise against “any form of tax increase” on Americans making less than $250,000 per year.

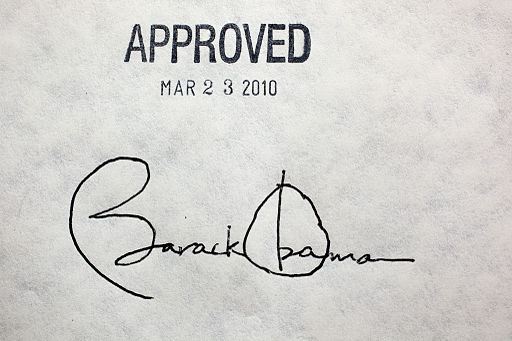

It is worth reminding Americans of Obama’s broken pledge:

“I can make a firm pledge. Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.” [Video]

Oct. 3, 2008: During a nationally televised Vice-Presidential debate in St. Louis candidate Joe Biden said:

“No one making less than $250,000 under Barack Obama’s plan will see one single penny of their tax raised whether it’s their capital gains tax, their income tax, investment tax, any tax.” [Transcript]

Feb. 24, 2009: In an address to a joint session of Congress President Obama restated the promise in forceful terms:

“If your family earns less than $250,000 a year, you will not see your taxes increased a single dime. I repeat: not one single dime.” [Transcript] [Video]

April 15, 2009: During a White House press briefing, spokesman Robert Gibbs was asked if Obama’s tax pledge applied “to the health care bill.” Gibbs replied:

“The statement didn’t come with caveats.” [Transcript] [Video]

Regardless of their eventual Obamacare tax liability, every American who files a tax return will be required to complete a new IRS form attesting to their “qualifying” health insurance status for each month of the year.