Featured Posts

Healthcare

JAMA Study on Price of Diabetes Medicines is Deceiving and Threatens Medical Innovation

In a recent study by the activist-funded JAMA Network, researchers erroneously “determined” that the price of diabetes medicines, like insulins, SGLT2 inhibitors, and…

Taxpayer Protection Pledge

Jefferson Shreve Makes “No New Taxes” Promise to Voters in IN-06 Race

Americans for Tax Reform (ATR) commends Jefferson Shreve for signing the Taxpayer Protection Pledge, a written commitment to the voters of Indiana…

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Record spending and a return to pushing tax hikes, that is the unfortunate reality of New Jersey Governor Phil Murphy’s budget proposal. Just last year,…

Filtered Posts

BREAKING: The Kansas Legislature Has Lost Its Mind

ATR Releases List of 2015 State Pledge Signers Following Primary Elections in New Jersey

Comprehensive List of Martin O’Malley Tax Hikes

Michigan Tax Hike Measure Goes Down in Flames, 80-20

Michigan Voters Faced With $2 Billion Tax Hike on May 5 Ballot

Ohio State House Republicans Push A Sound Tax Reform Agenda

Americans for Tax Reform Urges Gov. Hogan to Veto the Maryland Travel Tax Bill

Alabama Governor Insinuates He’ll Release Dangerous Prisoners Unless Lawmakers Raise Taxes

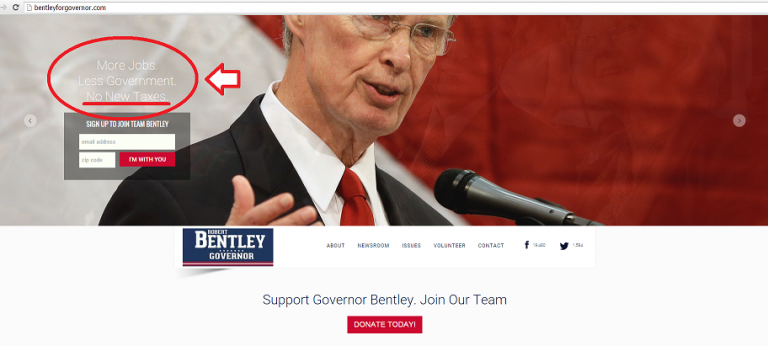

Robert Bentley Breaks His Pledge, Runs From the Truth