Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

BREAKING: The Kansas Legislature Has Lost Its Mind

ATR Releases List of 2015 State Pledge Signers Following Primary Elections in New Jersey

Comprehensive List of Martin O’Malley Tax Hikes

Michigan Tax Hike Measure Goes Down in Flames, 80-20

Michigan Voters Faced With $2 Billion Tax Hike on May 5 Ballot

Ohio State House Republicans Push A Sound Tax Reform Agenda

Americans for Tax Reform Urges Gov. Hogan to Veto the Maryland Travel Tax Bill

Alabama Governor Insinuates He’ll Release Dangerous Prisoners Unless Lawmakers Raise Taxes

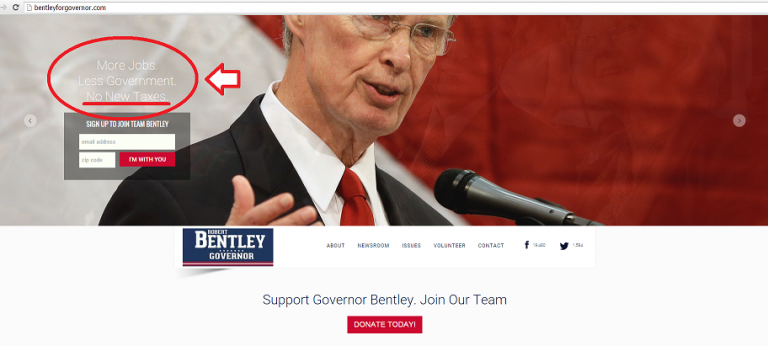

Robert Bentley Breaks His Pledge, Runs From the Truth