Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

BREAKING: The Kansas Legislature Has Lost Its Mind

ATR Releases List of 2015 State Pledge Signers Following Primary Elections in New Jersey

Comprehensive List of Martin O’Malley Tax Hikes

Michigan Tax Hike Measure Goes Down in Flames, 80-20

Michigan Voters Faced With $2 Billion Tax Hike on May 5 Ballot

Ohio State House Republicans Push A Sound Tax Reform Agenda

Americans for Tax Reform Urges Gov. Hogan to Veto the Maryland Travel Tax Bill

Alabama Governor Insinuates He’ll Release Dangerous Prisoners Unless Lawmakers Raise Taxes

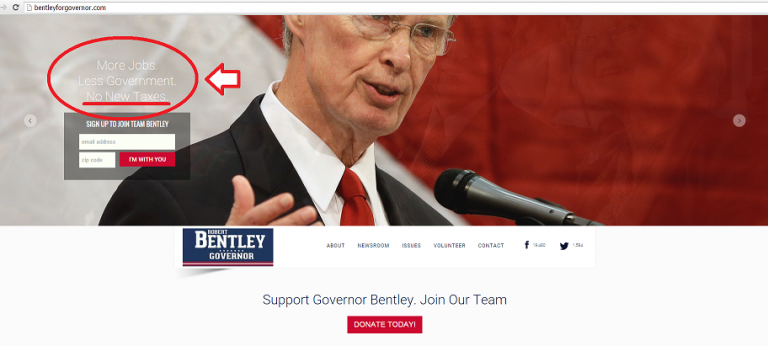

Robert Bentley Breaks His Pledge, Runs From the Truth