Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

ATR Statement on Permanent Tax Extenders Bill

Fact Checking Tammy Baldwin on Carried Interest Tax Hikes

ATR Supports H.R. 3762, the “Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015”

ATR Analysis of John Kasich Tax Plan

ATR Analysis of Rick Santorum Tax Plan

Open Letter to Congress on Bonus Depreciation

Puerto Rico Should Adopt Enterprise Zones, Not Austerity Tax Hikes

ATR Analysis of Donald Trump Tax Reform Plan

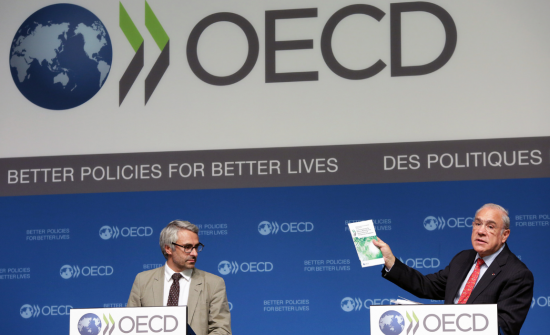

BEPS Is a French Acronym for “Tax Hikes”