Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

ATR Statement on Permanent Tax Extenders Bill

Fact Checking Tammy Baldwin on Carried Interest Tax Hikes

ATR Supports H.R. 3762, the “Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015”

ATR Analysis of John Kasich Tax Plan

ATR Analysis of Rick Santorum Tax Plan

Open Letter to Congress on Bonus Depreciation

Puerto Rico Should Adopt Enterprise Zones, Not Austerity Tax Hikes

ATR Analysis of Donald Trump Tax Reform Plan

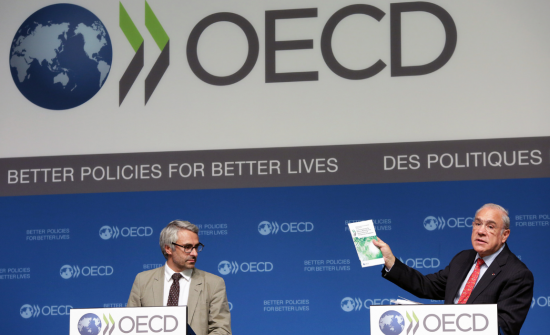

BEPS Is a French Acronym for “Tax Hikes”