Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

ATR Statement on Permanent Tax Extenders Bill

Fact Checking Tammy Baldwin on Carried Interest Tax Hikes

ATR Supports H.R. 3762, the “Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015”

ATR Analysis of John Kasich Tax Plan

ATR Analysis of Rick Santorum Tax Plan

Open Letter to Congress on Bonus Depreciation

Puerto Rico Should Adopt Enterprise Zones, Not Austerity Tax Hikes

ATR Analysis of Donald Trump Tax Reform Plan

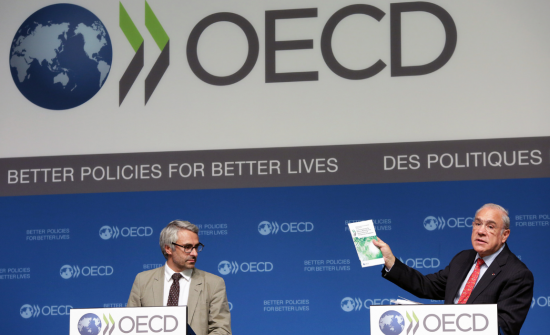

BEPS Is a French Acronym for “Tax Hikes”