Featured Posts

Tax Reform

Congestion Tax Highly Unpopular in New York

An overwhelming majority of New York voters oppose the new $15 “congestion toll” that is set to take effect in June. According to…

Criminal Justice

North Carolina Economy Loses $685 Million Due to Driver’s License Suspensions over Debt

North Carolina could be missing out on $684,756,000 in economic activity due to driver’s license suspensions over court debt. The state suspends 827,000 licenses for…

Consumer Affairs, Vaping

Biden Abandons Disastrous Menthol Prohibition Plan; Now Washington Needs To Embrace Harm Reduction

In a rare recognition of reality, the Biden Administration today finally agreed to drop their deeply flawed plans to introduce prohibition for Menthol cigarettes…

Filtered Posts

ATR Statement on Permanent Tax Extenders Bill

Fact Checking Tammy Baldwin on Carried Interest Tax Hikes

ATR Supports H.R. 3762, the “Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015”

ATR Analysis of John Kasich Tax Plan

ATR Analysis of Rick Santorum Tax Plan

Open Letter to Congress on Bonus Depreciation

Puerto Rico Should Adopt Enterprise Zones, Not Austerity Tax Hikes

ATR Analysis of Donald Trump Tax Reform Plan

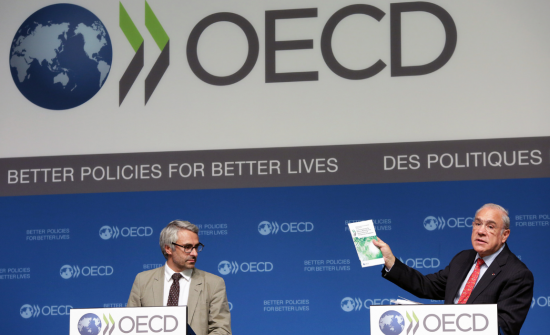

BEPS Is a French Acronym for “Tax Hikes”