Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

ATR Applauds Governor Ron DeSantis for Vetoing Flavored Vaping Ban

California’s Assault Against Ride-Sharing Services Shows Why National Preemption Necessary to Save the Gig Economy

Where Do the 2020 Democrats Stand on Vaping?

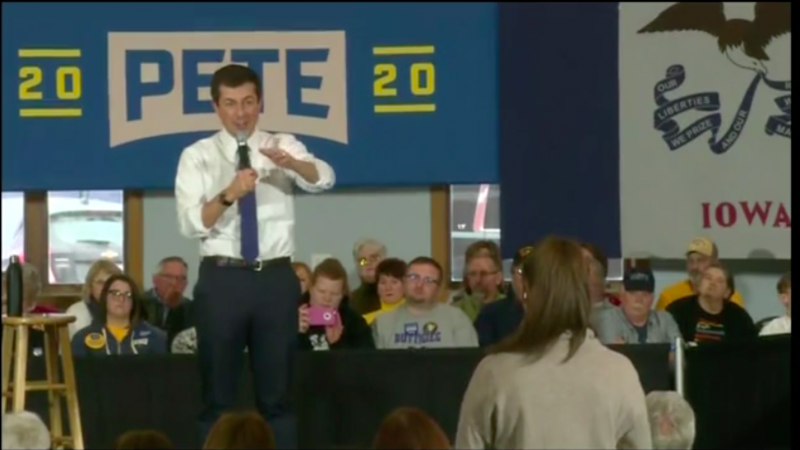

Pete Buttigieg Confuses Marijuana With Nicotine and Signals He’d Impose Harsher Regulations on Vaping

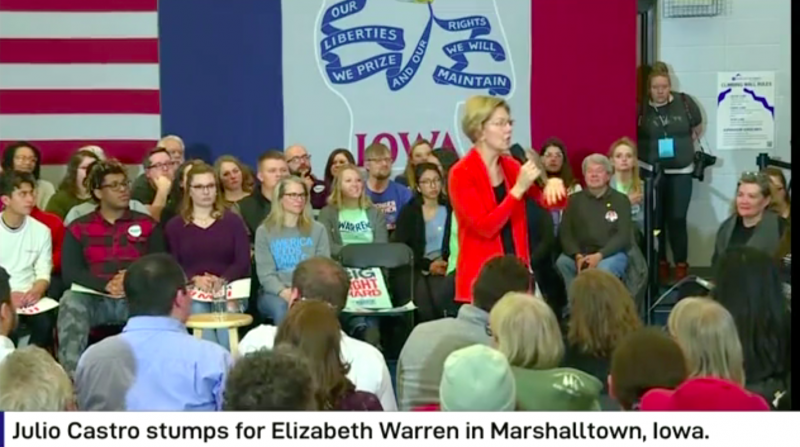

Elizabeth Warren’s Anti-Vaping Extremism Ignores Benefit of Vaping for Adult Smokers

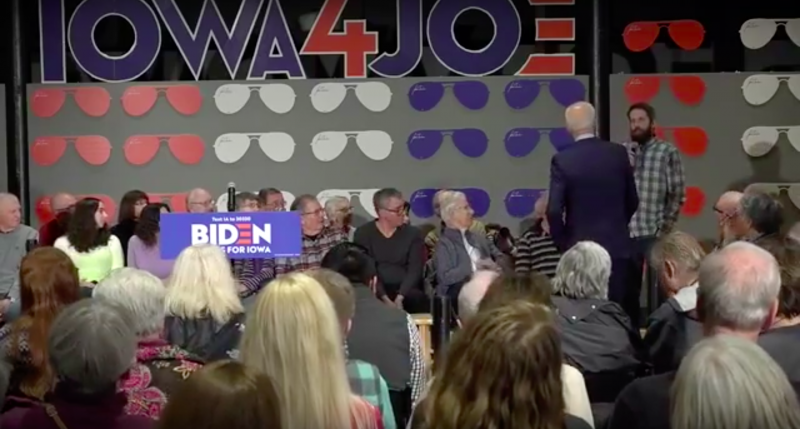

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

FDA’s Decision to Ban Some Vapor Products is a Compromise But Not a Complete Victory

Morning Consult Poll of Trump Voters: “Flavor Ban Could Cost Him Tenth of His Voters”

Congress Should Reject Additional Online Sales Restrictions for Adults Who Buy E-Cigarettes