Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

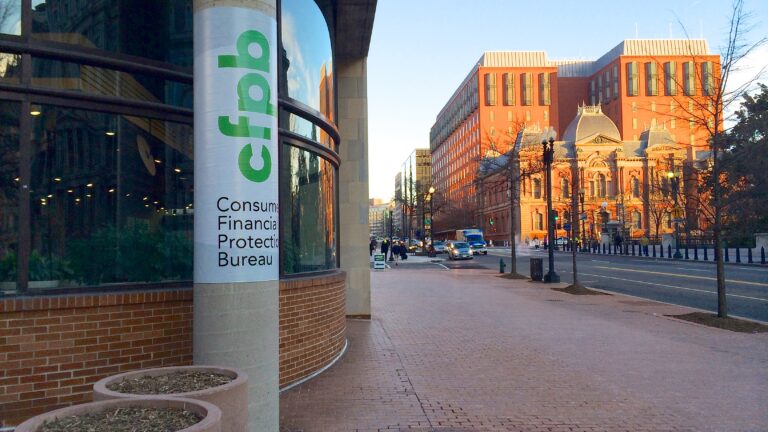

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

ATR Applauds Governor Ron DeSantis for Vetoing Flavored Vaping Ban

California’s Assault Against Ride-Sharing Services Shows Why National Preemption Necessary to Save the Gig Economy

Where Do the 2020 Democrats Stand on Vaping?

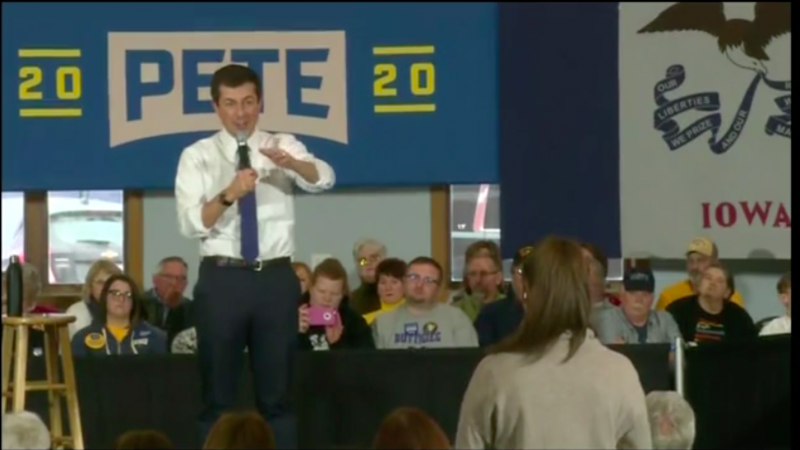

Pete Buttigieg Confuses Marijuana With Nicotine and Signals He’d Impose Harsher Regulations on Vaping

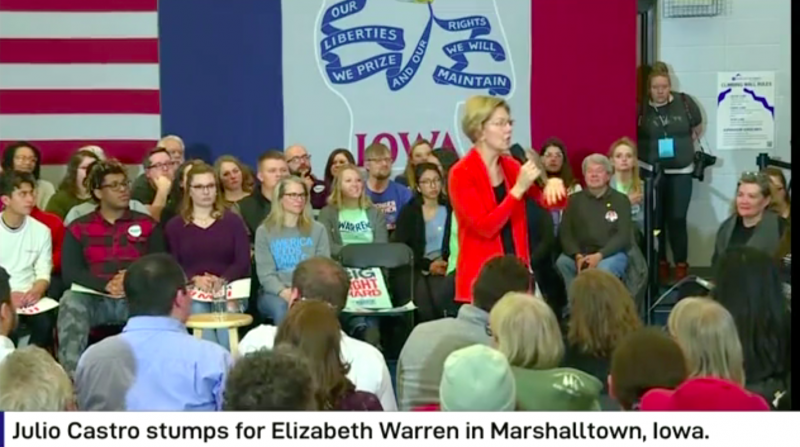

Elizabeth Warren’s Anti-Vaping Extremism Ignores Benefit of Vaping for Adult Smokers

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

FDA’s Decision to Ban Some Vapor Products is a Compromise But Not a Complete Victory

Morning Consult Poll of Trump Voters: “Flavor Ban Could Cost Him Tenth of His Voters”

Congress Should Reject Additional Online Sales Restrictions for Adults Who Buy E-Cigarettes