Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

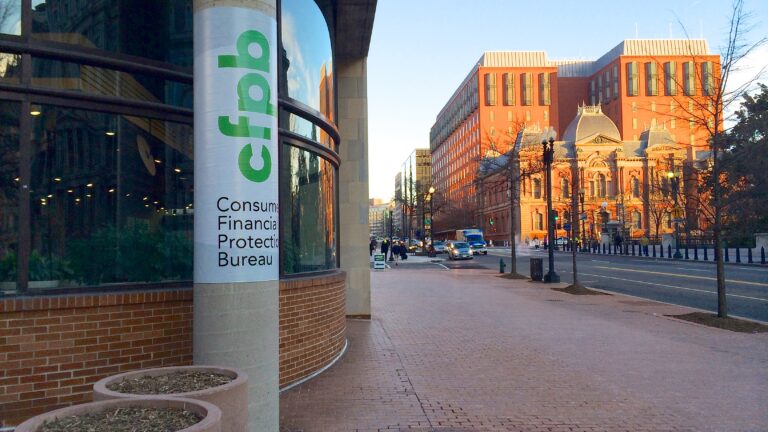

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

Consumer Affairs, Spending & Regulatory Reform

As New York City Bureaucrats Take Aim at Iconic Pizza Ovens, Texas Provides Model for Protection from Such Costly Mandates

News, Tax Reform

A Misguided Tax Hike Pending In Texas Just Got Worse

Tax Reform

Gavin Newsom Declares New Wealth Tax Dead On Arrival In California

Taxpayer Protection Pledge

Many New Taxpayer Protection Pledge Signers In Maine

Tax Reform

Representative John Andrews To Lead Taxpayer Protection Caucus In Maine House

Top Tier GOP Candidates Budd and McCrory Sign the Taxpayer Protection Pledge in N.C. Senate Race

Weak Showing Of Support For Governor Charlie Baker’s Regional Cap & Trade Scheme

California Voters Reject Property Tax Increase–Proposition 15

Massachusetts Voters Reject Ranked-Choice Voting–Question 2