Featured Posts

Tax Reform

Congestion Tax Highly Unpopular in New York

An overwhelming majority of New York voters oppose the new $15 “congestion toll” that is set to take effect in June. According to…

Criminal Justice

North Carolina Economy Loses $685 Million Due to Driver’s License Suspensions over Debt

North Carolina could be missing out on $684,756,000 in economic activity due to driver’s license suspensions over court debt. The state suspends 827,000 licenses for…

Consumer Affairs, Vaping

Biden Abandons Disastrous Menthol Prohibition Plan; Now Washington Needs To Embrace Harm Reduction

In a rare recognition of reality, the Biden Administration today finally agreed to drop their deeply flawed plans to introduce prohibition for Menthol cigarettes…

Filtered Posts

ATR Urges California Legislators To Vote No On SB 270

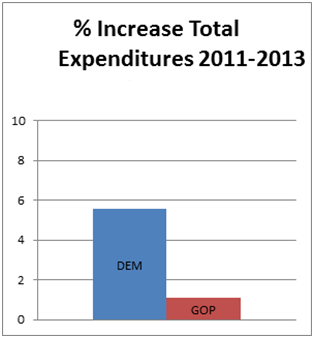

Democrat States Hike Spending at Quadruple the Rate of GOP States

Tax Increases Enacted by Democrat Governors Since 2011

Obama has Proposed 442 Tax Hikes Since Taking Office

Alabama Holds All Cards When It Comes To Needless Taxes