Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

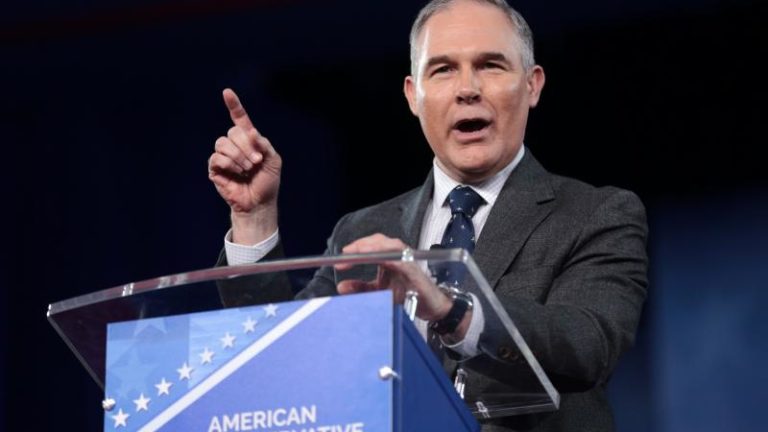

ATR Supports EPA Administrator Pruitt’s Work to Rein In RFS

ATR Support Rep. Mullin’s Amendments on Methane and Social Cost of Carbon

ATR Applauds Secretary Zinke’s Efforts to Improve Antiquities Act Designations

ATR Joins Coalition Calling on Congress to Repeal CFPB Arbitration Rule

ATR Opposes PFC Increase in THUD Appropriations Act

Happy Birthday Dodd-Frank…Hope It’s Your Last!

ATR Applauds Pruitt EPA for Moving to Rescind WOTUS

ATR Urges Senate Lawmakers to Oppose PFC Increase

ATR Urges Support for Davis-Cohen Airport Tax Amendment to House FAA Bill