Featured Posts

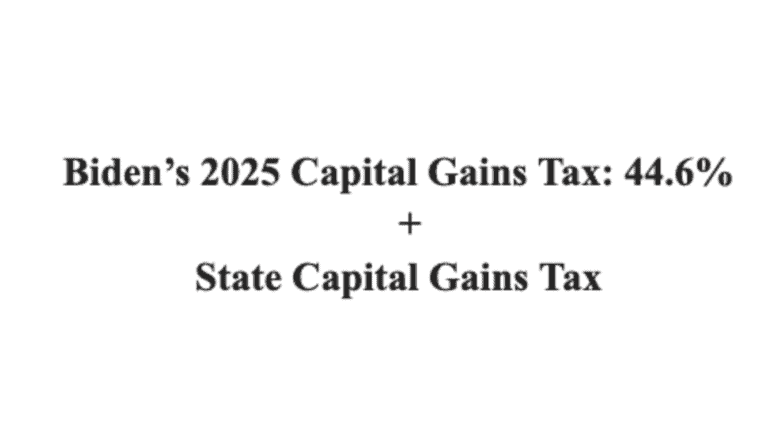

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Filtered Posts

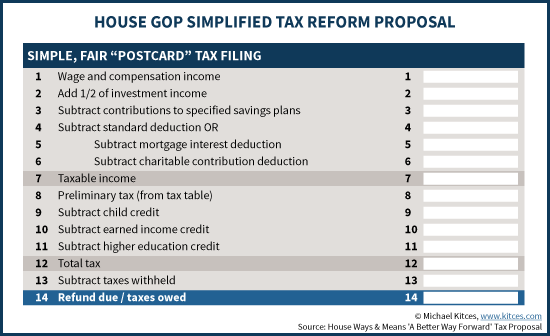

IRS Chief: We are running out of space on the 1040

Grover Norquist: Tax Reform Should Be Permanent

Norquist on Infrastructure: Time to Abolish Davis-Bacon

Fox News: 73% of Americans Want Tax Reform

Norquist: Obamacare Repeal Must Come Before Tax Reform, “Because The Alternative Is Too Awful.”

Norquist: AHCA is One of the Most Conservative Pieces of Legislation DC Has Ever Seen

Repeal Bill Abolishes Obamacare’s Chronic Care Tax on Middle Class

Norquist On Tax Reform: “Voters Are Smarter Than The Democrats Think They Are.”

Norquist Praises House GOP Tax Plan