Featured Posts

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Tax Reform

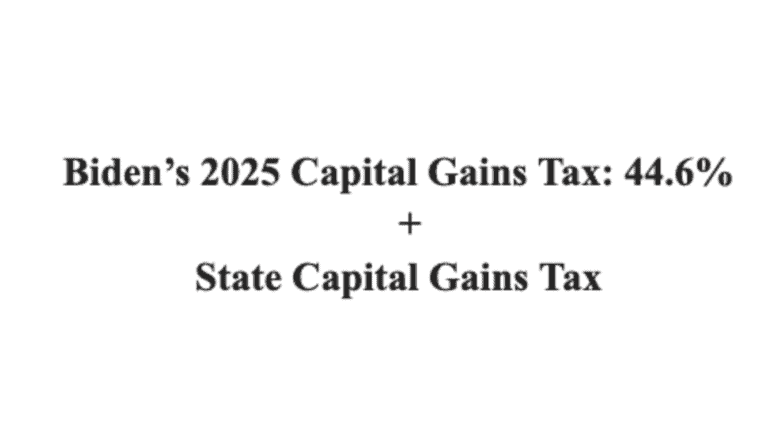

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states President Biden has…

Trade

ATR Applauds House Oversight For Investigating FTC-DOJ Strike Force

The House Committee on Oversight and Accountability is launching a probe into the rampant politicization of the Federal Trade Commission (FTC) by Chair Lina Khan…

Filtered Posts

Tax Reform

Governor Greg Abbott Aims To Keep Texas a National Leader in Limited Taxation

How the USA Was Born of a Tax Revolt

Treasury Should Give Taxpayers Certainty by Keeping Current Tax Filing Deadlines

Norquist: Tax Cuts are As American as July 4, 1776

Congress Needs To Act Soon To Stop the Imminent Obamacare Health Insurance Tax

Don’t Screw Up Tax Reform, or the Economy Won’t Grow in Time for the Midterms

Grover Norquist: Tax Reform is a Must Win for Republicans (and it really could happen)

Why the Trump Tax Cut is Necessary

The Promised Land of Trump’s Tax Plan?