Featured Posts

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Biden announces intention to break his $400k tax pledge Today President Biden said that if elected to a second term he will make sure…

Taxpayer Protection Pledge

Brad Knott Makes “No New Taxes” Promise to Voters in NC-13 Run-off

Americans for Tax Reform (ATR) commends former federal prosecutor Brad Knott for signing the Taxpayer Protection Pledge,…

Filtered Posts

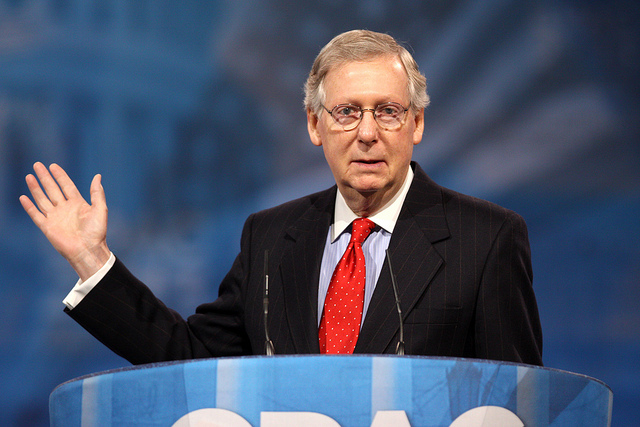

Conservative Groups Unify Around McConnell Strategy to Protect States Against EPA Power Grab

Lookout! Congress Considering Increasing the Cost of Flying

The Environmental Lobby’s Ludicrous Polls

Norquist Letter to Congress: Don’t Raise the Gas Tax, instead…

No Need To Raise The Gas Tax

Obama To Veto Keystone Pipeline

Senate Committee Report Details Environmentalists’ Inner Workings

ATR Endorses Sen. Toomey’s Highway Amendment to Help Rebuild Disaster Areas