Featured Posts

Taxpayer Protection Pledge

ATR Commends Pennsylvania Pledge Signers Ahead of April 23 Primary

As Pennsylvania Primary voters head to the voting booth, they deserve to know where their candidates stand on crucial issues such as taxes and spending.

Conservative Movement Leaders Oppose Motion to Vacate

A coalition of more than 40 conservative movement leaders released a letter today urging the House to oppose a vote on the motion to vacate…

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Filtered Posts

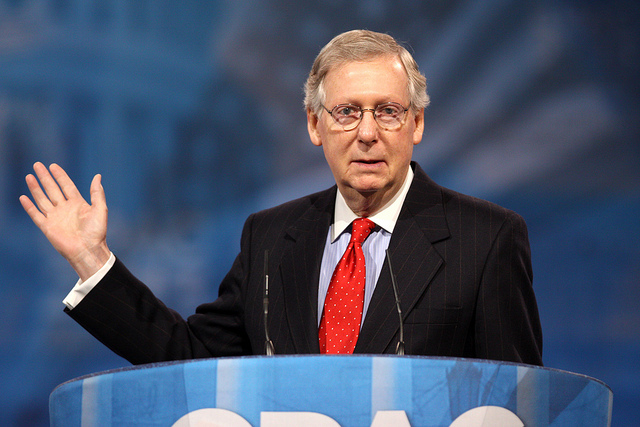

Conservative Groups Unify Around McConnell Strategy to Protect States Against EPA Power Grab

Lookout! Congress Considering Increasing the Cost of Flying

The Environmental Lobby’s Ludicrous Polls

Norquist Letter to Congress: Don’t Raise the Gas Tax, instead…

No Need To Raise The Gas Tax

Obama To Veto Keystone Pipeline

Senate Committee Report Details Environmentalists’ Inner Workings

ATR Endorses Sen. Toomey’s Highway Amendment to Help Rebuild Disaster Areas