Featured Posts

Tech & Telecom, Trade

ATR Applauds House Ways and Means for Holding USTR Accountable

House Republicans have strongly criticized United States Trade Representative (USTR) Katherine Tai for the Biden administration’s recent blunders on digital trade. In a House…

Joe Biden and Kamala Harris Will Raise Your Taxes

Joe Biden and Kamala Harris will raise your taxes. They will impose income tax hikes, small business tax hikes, capital gains tax hikes, corporate…

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Filtered Posts

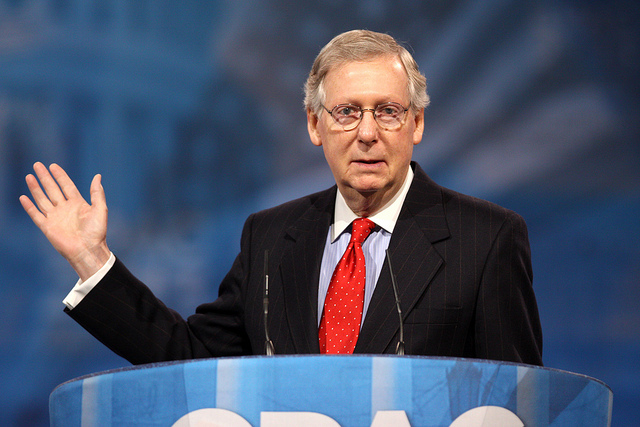

Conservative Groups Unify Around McConnell Strategy to Protect States Against EPA Power Grab

Lookout! Congress Considering Increasing the Cost of Flying

The Environmental Lobby’s Ludicrous Polls

Norquist Letter to Congress: Don’t Raise the Gas Tax, instead…

No Need To Raise The Gas Tax

Obama To Veto Keystone Pipeline

Senate Committee Report Details Environmentalists’ Inner Workings

ATR Endorses Sen. Toomey’s Highway Amendment to Help Rebuild Disaster Areas