Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

Trade

EU Targets U.S. Companies Under New Digital Markets Act

Tax Reform

Biden’s Global Minimum Tax Cartel Hurts Americans

Regulation, Trade

Europe’s Attack on Apple: A Misguided Overstep

Regulation

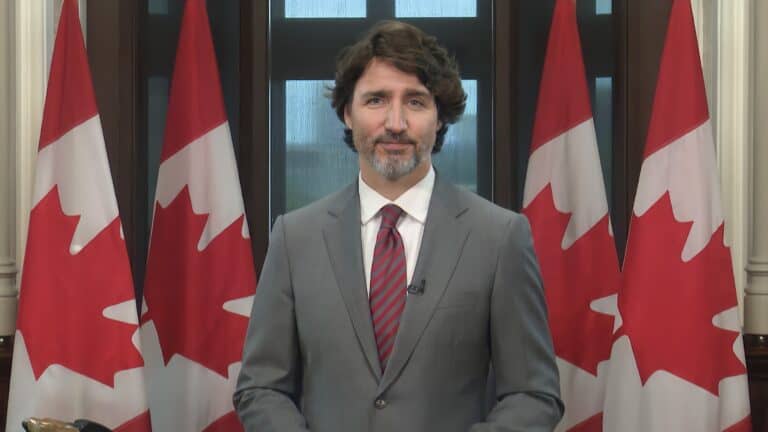

Canada’s CRTC Attacks American Streaming Platforms – A Menace to Consumers And Innovation

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Tax Reform

ATR President Grover Norquist Supports Hungary’s Rejection of Global Minimum Tax Proposal

Tax Reform

ATR Statement: EU’s Digital Markets Act Undermines Transatlantic Security

Tax Reform

USTR Must Strongly Oppose Canada’s Digital Tax on American Companies

Taxpayer Groups from 40 Countries Urge Rejection of OECD’s Global Minimum Tax