Featured Posts

Senator Crapo Calls Out IRS Chief for Misleading Congress About “Direct File”

Sen. Mike Crapo (R-Idaho), ranking member of the Senate Finance Committee, questioned IRS commissioner Daniel Werfel yesterday about Werfel’s dishonesty to Congress regarding the IRS…

Financial Services

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Financial Services

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Filtered Posts

Taxpayer Protection Pledge

Ron DeSantis Signs Presidential Taxpayer Protection Pledge to the American People

Taxpayer Protection Pledge

Ben Toma First to Make “No New Taxes” Promise in AZ-08 GOP Primary

Taxpayer Protection Pledge

Kevin Coughlin First to Make “No New Taxes” Promise in OH-13 GOP Primary

Taxpayer Protection Pledge

Frank LaRose Makes “No New Taxes” Promise to Voters in OH U.S. Senate Race

Taxpayer Protection Pledge

Russell Prescott First to Make “No New Taxes” Promise to Voters in NH-01 Race

Taxpayer Protection Pledge

Scott James First to Make “No New Taxes” Promise to Voters in CO-08 Race

Taxpayer Protection Pledge

Tim Scott Signs Presidential Taxpayer Protection Pledge to the American People

Taxpayer Protection Pledge

Doug Burgum Signs Presidential Taxpayer Protection Pledge to All Americans

Taxpayer Protection Pledge

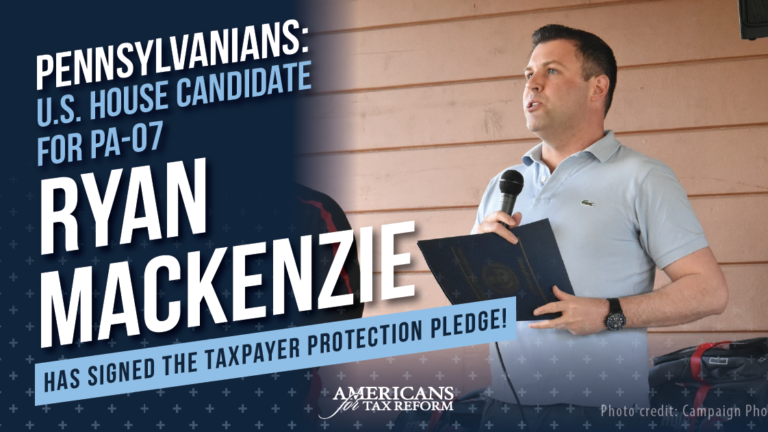

Ryan Mackenzie First to Make “No New Taxes” Promise in PA-07 Congressional Race

Taxpayer Protection Pledge