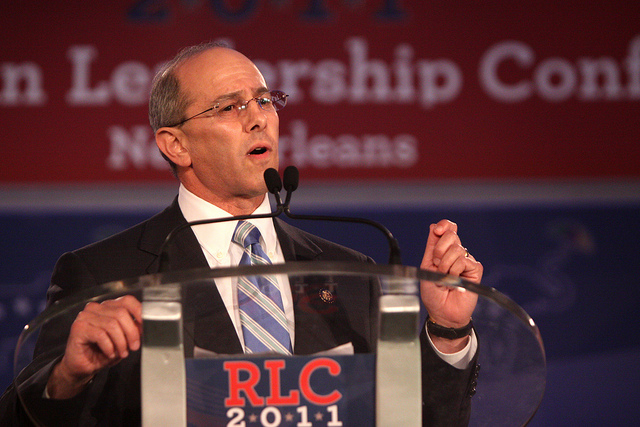

This week the House is slated to vote on H.Con.Res.112 introduced by Rep. Charles W. Boustany (R-La.) that would put Congress on the record in opposition to President Obama’s proposed $10 per barrel tax on oil.

With Obama’s 2016 proposal of a $10 per barrel oil tax, Boustany’s resolution would be a positive step toward protecting low to middle income Americans and businesses from yet another disastrous tax burden proposed by the President. The administration clearly does not realize the economic burden such a tax increase would have on the country.

Under President Obama’s oil tax, families can expect to see gas prices rise by at least 25 cents. With the current state of the economy, our low to middle income families cannot afford such an increase. Depending on the state, consumers could also once again see gas prices rise well above $2 per gallon. Many hardworking, low-income families will be forced to pay over $144 per year more than average.

According to reports from the Tax Foundation, Obama’s proposed oil tax will also impact the U.S. economy as whole, with a projected $48 billion annual loss in GDP, along with nearly 137,000 jobs being destroyed. With the Administration already pushing a slew of economically disastrous polices, it is disheartening for Americans to be subjected to yet another proposal that seeks to harm, not create, economic growth.

While the President seems to have an agenda that is void of economic reality, members of Congress such as Rep. Boustany are fighting to help keep energy costs affordable and to help the economy grow. Obama is clearly indifferent to the harm his “legacy” is causing hard-working American families and businesses.

Americans for Tax Reform urges members of Congress to support and vote for Rep. Boustany’s resolution opposing Obama’s economically disastrous tax on oil.

Photo credit: Gage Skidmore