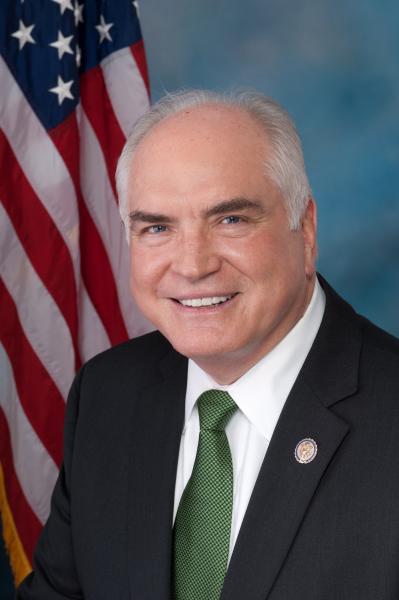

Representative Mike Kelly (R-Pa.) introduced H.R. 1026, the “Taxpayer Knowledge of IRS Investigations Act.” This bill amends the tax code to stop the IRS’s outrageous abuse of taxpayer privacy protections to instead protect government employees who improperly look at or reveal taxpayer information.

Congressman Kelly explains:

“The revelation of the IRS’s targeting of innocent American citizens shook the foundation of the American people’s relationship with their government. The scandal took a sharp turn for the worse when we discovered private taxpayer information was leaked to outside organizations in a deliberate attempt to attack them for their political views. Insult was added to injury when the victims of this potential abuse were denied access to any information about the agency’s investigation into whether criminal wrongdoing occurred. The Taxpayer Knowledge of IRS Investigations Act will restore essential accountability to this troubled agency by changing the tax code to grant American citizens the critical transparency that they deserve but have been wrongly denied. If a citizen believes his or her private information has been compromised, the government should never be able to hide behind the very protections intended for them to instead protect the wrongdoer.”

The IRS has used legislation meant to protect the personal information of taxpayers to dodge accountability for its actions. H.R. 1026 will help to bring these unethical practices to light.

Oversight Subcommittee Chairman Peter Roskam expressed his support for H.R. 1026:

“This bill seeks to end the misuse of a provision of the tax code designed to protect taxpayer information that is now being exploited to protect the government employees who are accountable for this outrageous practice.”