Americans for Tax Reform 2016 Ballot Measure Guide

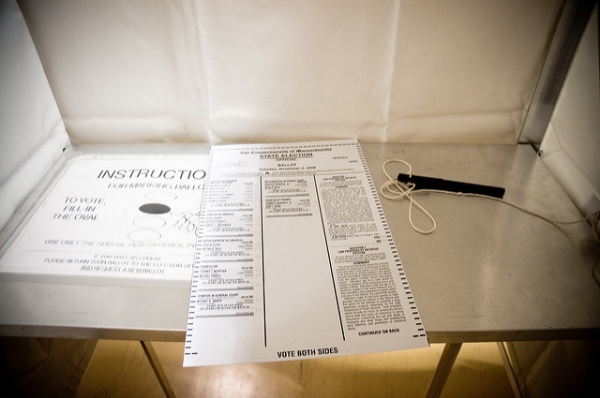

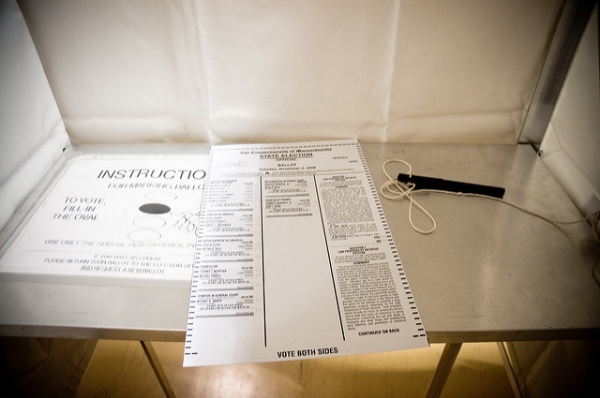

On November 8, 2016, millions of Americans will head to the polls to vote for the next President of the United States. But that is not the only important decision voters will make that day.

In addition to choosing preferred candidates for public office at the federal, state, and local levels, voters will face decisions on ballot measures that will shape the United States for years to come. Ballot measures will appear on the ballot in most states, asking voters to approve new statutes or constitutional amendments dealing with tax, health care, transportation, labor, and other policy issues.

Ballot measures can be referred to the ballot by state legislators, or placed there through a citizen-initiated petition process. This year, the number of citizen-initiated measures on the ballot is more than double that of the 2014 election. More remarkable is that this year, for the first time since 1950, there will be more citizen-initiated measures on the ballot than the number of legislatively-referred measures referred.

Americans for Tax Reform has examined the roughly 160 statewide measures that will appear on the November ballot, and put together a guide on those measures that will have the greatest impact on taxpayers and economic growth.

Among the many policy issues addressed by the ballot measures this fall, it’s worth noting that there are a particularly high number of states considering measures that would increase the minimum wage and raise tobacco taxes, as well as cities considering higher taxes on soda.

Notable Tax-Related Ballot Measures

California Proposition 67, Plastic Bag Ban Veto Referendum

Americans for Tax Reform Stance: Oppose

Proposition 67, if approved by voters, would uphold a 2014 state law banning the use of plastic bags and charging consumers a 10 cent on every paper bag used at checkout. All revenue collected from this bag tax would go to grocery stores, not state government coffers.

Prop. 67’s approval would result in a multi-million dollar tax increase on consumers that will do nothing to improve the environment but will transfer income from low and middle-income households to the bank accounts of large corporations.

Result: (Too close to call) Approved – 51.93% Yes, 48.07% No

California Proposition 65, Dedication of Revenue from Disposable Bag Sales to Wildlife Conservation Fund

Americans for Tax Reform Stance: Support

Proposition 65 is an initiative statute to Proposition 67 that would direct all bag tax revenue away from grocery stores, as current law stipulates, and instead towards the Environmental Protection and Enhancement Fund, a new fund that would be managed by Wildlife Conservation Board.

Americans for Tax Reform opposes California’s plastic bag ban and paper bag tax. Yet if Prop. 67 is approved and the paper bag tax remains on the books, revenue raised by it should go to public coffers instead of private companies. As such, ATR opposes Prop. 67, while supporting Prop. 65.

Result: Defeated – 44.62% Yes, 55.38% No

California Proposition 55, Extension of the Proposition 30 Income Tax Increase

Americans for Tax Reform Stance: Oppose

Proposition 55 would extend the higher temporary income tax rates approved by voters in 2012 on incomes exceeding $250,000 a year. If this measure is approved, the higher income tax rates will remain in place through 2030. However, if voters reject Prop. 55, these tax increases will begin phasing out in 2018.

Currently, California’s top marginal income tax ranks highest in the nation at 13.3 percent. Second highest in the nation, Oregon, is more than 3 percentage points lower. Keeping such a high rate in place for a longer period of time will continue to hamstring the state economically and will be particularly harmful to small businesses owners who pay their taxes on their individual income tax return.

Result: Approved – 62.11% Yes, 37.89% No

Colorado Creation of ColoradoCare System, Amendment 69

Americans for Tax Reform Stance: Oppose

Amendment 69’s approval would raise taxes to fund of ColoradoCare, which will oversee all aspects of healthcare for all Coloradans. ColoradoCare would be funded through a massive $25 billion tax increases levied off most sources of income

If Amendment 69 is approved by voters, the Colorado Department of Revenue would collect a 10 percent payroll tax, with employees paying 3.33 percent and employers paying 6.67, along with a 10 percent tax on all non-payroll income. The tax increases associated with the measure would devastate the Colorado’s private sector.

Result: Defeated – 20.32% Yes, 79.68% No

Illinois Transportation Taxes and Fees Lockbox Amendment

Americans for Tax Reform Stance: Support

This amendment would add a section to the Revenue Article of the Illinois Constitution that would prevent lawmakers from using transportation funds for projects other than their stated purpose.

Diversion of gas tax revenue to non-transportation purposes is a problem in many states. Safeguards to prevent such diversion reduce pressure to raise gas taxes. Similar measures are in place in both Maryland and Wisconsin.

Result: Approved – 78.9% Yes, 21.1% No

Maine Tax Hike on Incomes Exceeding $200,000, Question 2

Americans for Tax Reform Stance: Oppose

Question 2 would increase taxes on total household incomes exceeding $200,000 per year by 3 percentage points, which represent a more than 40% rate hike.

Maine’s current top state marginal individual income tax rate is 7.15 percent. This ranks 11th highest of states that tax individual income. Increasing this rate to 10.15 would make Maine’s rate 2nd highest in the nation based off of 2016 rankings. Approval of Question 2 will have Maine residents sending more of their hard-earned income to Augusta, and result in a significant reduction in the job-creating capacity of Maine small businesses.

Result: (Too close to call) Approved – 50.41% Yes, 49.59% No

Missouri Sales Tax, Amendment 1

Americans for Tax Reform Stance: Oppose

Amendment 1 would keep the 0.1 percent sales and use tax in place that funds soil and water conservation efforts and the state park system. This tax was put in place through a 1984 constitutional amendment which must be reapproved by voters every 10 years. Approval of Amendment 1 would renew this sales tax for another decade. If it fails, it will not be referred to future ballots.

Currently, Missouri’s combined state and average local sales tax is 14th highest in the nation. The 0.1 percent sales tax that Amendment 1 asks voters to extend costs taxpayers an estimated $90 million each year.

Result: Approved – 80.14% Yes, 19.86% No

New Jersey Dedication of All Gas Tax Revenue to Transportation, Public Question 2

Americans for Tax Reform Stance: Support

Public Question 2 would dedicate all gas tax revenue to transportation projects. Under current law, only 10.5 cents of the state’s gas and diesel fuel tax is appropriated for transportation projects.

If Public Question 2 is approved, New Jersey taxpayers would no longer need to worry about money-hungry lawmakers shaking them down at the pump to fund government programs that have nothing to do with maintaining and building roads.

Result: Approved – 50.33% Yes, 46.45% No

Oklahoma 22 Percent Sales Tax Hike, State Question 779

Americans for Tax Reform Stance: Oppose

State Question 779, if approved, would increase Oklahoma’s state sales tax by 1 percentage point, which represents a more than 22% hike in the state sales tax rate, and is estimated to equal $615 million in annual revenue. Oklahoma’s current combined state and local average sales rate is already 6th highest in the nation.

Result: Defeated – 40.59% Yes, 59.41% No

Oregon Business Tax Increase, Measure 97

Americans for Tax Reform Stance: Oppose

Measure 97 would implement a 2.5% gross receipts tax in Oregon on all corporate sales exceeding $25 million.

Though Measure 97 is described as a corporate tax increase, the burden will be borne by all. Measure 97 is estimated to cost each Oregonian resident $600 a year. “Because of its pyramiding effect,” notes the Wall Street Journal editorial board, “the tax would get baked into the cost of everything from a t-shirt to a TV. Businesses at the end of the supply chain would get soaked.

If implemented, Measure 97 would be the largest tax increase in the state’s history, and increase the size of the state budget by a third. Gross receipts taxes are viewed by economists across the political spectrum as one of the most economically damaging forms of taxation. For this reason, they are only levied in a small handful of states.

Result: Defeated – 40.89% Yes, 59.11% No

Washington Carbon Tax, Initiative 732

Americans for Tax Reform Stance: Oppose

Initiative 732 would phase in a $25 per metric ton carbon tax over a period of two years. After reaching $25, the tax would continue to increase by 3.5 percent plus the rate of inflation until the tax reaches $100.

Energy produced from natural gas and coal offer affordable and reliable sources of energy. Using such sources keeps costs low, and ensures low-income families are able to afford electricity. By forcing companies to pay a carbon tax, and pushing them onto more expensive, less reliable sources, utility costs will rise. A carbon tax will thus have a disproportionate and regressive impact on low-to-middle income families who spend the largest share of household income on energy.

Not only will this limit the affordability of electricity, it will also cost jobs, increase the costs of consumer goods, and have an overall detrimental economic effect on the state of Washington.

Result: Defeated – 41.54% Yes, 58.46% No

Numerous Tobacco Tax Measures

Cigarettes and tobacco products have historically been one of the top targets for tax-hiking politicians looking for money to spend. Tobacco excise taxes, like other discriminatory levies, unfairly burden specific industries and low-income households. As it happens, smokers earn far less income on average than non-smokers, making tobacco taxes among the most regressive.

Further, because state tobacco tax rates vary so drastically from state to state, high tobacco taxes serve to promote illegal activity, as criminals purchase cigarettes in states with lower tax rates and smuggle them into states with higher rates to sell on the black market. It’s no coincidence that New York has both the highest cigarette tax in the country and the highest rate of cigarette smuggling. Because of this, tobacco taxes often miss revenue projections and serve as placeholders for future tax hikes on the broad populace. Of the 32 state tobacco tax increases that went into effect between 2009 and 2013, only three met or exceeded revenue projections, according to industry data.

The following in a rundown of 2016 ballot measures that seek to raise tobacco taxes:

Colorado Tobacco Tax Increase, Amendment 72

Americans for Tax Reform Stance: Oppose

Amendment 72 would increase the tobacco excise tax by $1.75 per 20-pack, tripling the state’s current rate and resulting in one of the nation’ highest tobacco excise tax rates. Additionally, all other tobacco products, excluding e-cigarettes would be taxed at 22 percent of the manufacturer’s list price. These changes are projected to amount to a $315.7 million tax increase.

Result: Defeated – 46.4% Yes, 53.6% No

Missouri 23-Cent Cigarette Tax, Proposition A

Americans for Tax Reform Stance: Oppose

Proposition A would raise the cigarette tax by 23 cents per pack by 2021. Further, this measure would also add an additional 5 percent sales tax to other tobacco products. When in full force, Proposition A is estimated to be a $95-103 million annual tax hike, which would be used exclusively on transportation infrastructure projects.

Result: Defeated – 44.74% Yes, 55.26% No

Missouri 60-Cent Cigarette Tax, Constitutional Amendment 3

Americans for Tax Reform Stance: Oppose

Constitutional Amendment 3 would raise the cigarette tax from 17 to 77 cents per 20-pack in 15 cent increments by 2020. Additionally, an “equity assessment fee” of 67 cents per pack would be imposed on manufacturers who did not sign the Tobacco Master Settlement Agreement (TMSA) of 1998. Many agree this fee would primarily burden smaller tobacco companies.

This measure is projected to be a $263-$374 million a year when fully implemented.

Result: Defeated – 40.36% Yes, 59.64% No

*Should both of Missouri’s tobacco tax initiatives win approval, the one with the most supported measure supersedes.

North Dakota Tobacco Tax Increase, Initiated Statutory Measure 4

Americans for Tax Reform Stance: Oppose

Measure 4 would increase the state tobacco tax from 44 cents to $2.20 per pack, as well as raise the tax on all other tobacco products from 28 percent to 56 percent of the wholesale purchase price. Liquid nicotine and electronic inhalation devices would be included in the definition of “tobacco product.”

This tax increase would make North Dakota’s tobacco excise tax among the highest in the nation, and would make North Dakota among the handful of states that tax e-cigarettes, which are safer alternatives to regular cigarettes and been described as smoking cessation devices.

Result: Defeated – 38.48% Yes, 61.52% No

California Tobacco Tax Increase, Proposition 56

Americans for Tax Reform Stance: Oppose

Proposition 56 would increase the state cigarette tax by $2.00 per pack, resulting in a total cigarette tax of $2.87 per pack. This increase would be equivalently applied to other tobacco products as well.

In that vein, Prop 56 would also expand the state definition of “other tobacco products” to include e-cigarettes, which would hold these innovative, safer alternatives to traditional cigarettes to the taxes outlined in Proposition 99 and Proposition 10.

Prop 56 would make California’s cigarette tax rate within the 10 highest in the nation and make it among the few states that taxes e-cigarettes.

Result: Approved – 62.9% Yes, 37.1% No

Local Tax-Related Ballot Measures

San Diego, California, Football Stadium Initiative, Measure C

Americans for Tax Reform Stance: Oppose

Measure C would raise the city’s hotel room tax to finance the construction of a new stadium for the San Diego Chargers, and additional convention center space.

Currently, the city’s hotel room tax is 10.5 percent, which is collected with an additional 2 percentage point surcharge to fund the Tourism Marketing District for an effective total hotel tax of 12.5 percent. Measure C would lower the Tourism Marketing District down to 1 percent, however, the overall effective rate would still increase to 16.5 percent. Approval of Measure C would result in a nearly 60 percent increase in the San Diego hotel tax.

Result: Defeated – 41.16% Yes, 58.84% No

Fairfax County Meals Tax Referendum

Americans for Tax Reform Stance: Oppose

This tax would impose an additional 4 percentage point tax to the 6 percent sales tax already levied on ready-to-eat meals and prepared food, which represents a whopping 66 percent rate hike. This total 10 percent tax would be levied on food purchased from grocery stores, restaurants, food trucks, pizza deliveries, movie theaters, coffee shops and more.

This tax increase is projected to generate nearly $100 million dollars per year. This tax will disproportionately burden lower-income and middle-class families, and will harm small businesses and kill jobs.

Result: Defeated – 44% Yes, 56% No

Numerous Local Soda Tax Ballot Measures

Americans for Tax Reform Stance: Oppose

Voters in San Francisco & Oakland, CA, as well as Boulder, CO will face ballot questions asking them to approve punitive tax hikes on soda.

Simply put, discriminatory soda tax hikes are regressive cash grabs that will do nothing to improve public health.

One of the few times Senator Bernie Sanders (I-VT) has ever been correct about any fiscal policy issue was when he pointed out on the presidential campaign trail this year that soda tax hikes are “fairly regressive. And that is, it will be increasing taxes on low-income and working people.”

Result in San Francisco: Approved – 62% Yes, 38% No

Result in Oakland: Approved – 61% Yes, 39% No

Result in Boulder: Approved – 54% Yes, 46% No

Economically Significant Non-Tax-Related Ballot Measures

Oklahoma Regulations Governing the Sale of Wine and Beer, State Question 792

Americans for Tax Reform Stance: Support

State Question 792 would modernize current state laws governing the sale and distribution of alcoholic beverages. Among other things, SQ 792 would allow grocery and convenient stores to sell refrigerated, full-strength beer and wine, as well as allow alcoholic accessories to be sold in the same place as alcohol.

Current law does not give Oklahomans the same access to wine and beer as the vast majority of Americans. This not only makes it difficult for people in the state to get a hold of their preferred beverage. SQ 792 would address these problems by expanding consumer choice and convenience, as Oklahomans would no longer need to go out of their way or even cross state lines to purchase their favorite adult beverages.

Result: Approved – 65.61% Yes, 34.39% No

Minimum Wage Hiking Measures

While initiatives to raise the minimum wage may have good intentions, they have negative unintended consequences for workers and harmful economic effects.

In practice, minimum wage hikes do little in terms of lifting people above the poverty line. More often, they reduce opportunities for students and young workers who lack skills and experience. Indeed, since minimum wage increases make operating a business more expensive, it is unsurprising that numerous studies have found minimum wage hikes cost jobs, increase consumer costs, and deter businesses and investment. Even Paul Krugman has pointed out the harm done by minimum wage hikes:

“A recent report commissioned by the commonwealth’s government argues that its economy is hurt by sharing the U.S. minimum wage, which raises costs, and also by federal benefits that encourage adults to drop out of the work force. In principle these complaints could be right. In particular, even economists who support a higher U.S. minimum wage, myself included, generally agree that it could be a problem if set too high relative to productivity…”

The following is a run down of all the 2016 ballot measures that seek to raise state-set minimum wages:

Arizona Minimum Wage and Paid Time Off, Proposition 206

Americans for Tax Reform Stance: Oppose

Proposition 206 would increase the minimum wage from $8.05 to $10 in 2017, and then incrementally increase it to $12 by 2020. Afterward, from 2021 forward, the minimum wage would increase with the cost of living.

Additionally, prop 206 would require large employers – 15 or more employees – to provide employees with 40 annual hours of paid sick leave and small employers – fewer than 15 employees – to provide 24 hours. Employees would also be entitled to accrue more paid time off at a rate of one hour earned for every 30 hours worked.

Result: Approved – 59.13% Yes, 40.87% No

Colorado $12 Minimum Wage, Amendment 70

Americans for Tax Reform Stance: Oppose

Amendment 70 would increase the state’s minimum wage from $8.31 to $9.30 per hour in 2017. This measure would then increase the minimum wage in 90-cent increments on January 1st of each year until it reaches $12 in 2020.

After 2020, the minimum wage would increase with the cost of living. Under current law, Colorado’s minimum wage is annually adjusted for inflation.

Result: Approved – 54.3% Yes, 45.7% No

Maine Minimum Wage Increase, Question 4

Americans for Tax Reform Stance: Oppose

Question 4 would increase the state minimum wage to $12 by 2020, and then continue to adjust it in accordance with changes in the Consumer Price Index (CPI). Further, Question 4 would increase the wage for tipped workers $5 an hour in 2017, and then by $1 annually until it equals the general minimum wage, with 2024 as a deadline.

Result: Approved – 55.56% Yes, 44.44% No

South Dakota Decreased Youth Minimum Wage Veto Referendum, Referred Law 20

Americans for Tax Reform Stance: Support

Referred Law 20 would support Senate Bill 177, a 2015 law that sets the state minimum wage for workers under age 18 to $7.50 an hour rather than $8.50 an hour. No annual cost of living adjustments would be required for the youth minimum wage.

Result: Defeated – 28.86% Yes, 71.14% No

Washington Minimum Wage Increase, Initiative 1433

Americans for Tax Reform Stance: Oppose

Initiative 1433 would raise the state minimum wage from $9.47 to $11.00 in 2017, and then increase incrementally until reaching $13.50 in 2020. Then, starting in 2021, the minimum wage would adjust with inflation.

Initiative 1433 would also mandate employers offer employees one hour of paid sick per 40 hours worked. At the very least, employees would be allowed to earn 40 hours of paid sick leave annually. Unused sick days would roll over to the next year.

Result: Approved – 59.54% Yes, 40.46% No

Right-to-Work Measures

There are also a number of Right-to-Work measures on the ballot. Right-to-Work laws free workers from being forced to join a union and pay union dues as a condition of employment. Right-to-Work laws promote worker freedom, and, as ATR’s Patrick Gleason pointed out in an article for Forbes, states that have such laws on the books have outperformed non-Right-to-Work states:

“Not only is the average unemployment rate lower in Right to Work states, workers have greater purchasing power than those in forced union states. The University of Colorado’s Dr. Barry Poulson found in a 2005 study that metropolitan area residents in Right to Work states have an average after-tax purchasing power nearly $4,300 greater than their counterparts in non-Right to Work states. According to a study by Ohio University economist Richard Vedder, per capita income rose 23% faster in right-to-work states than forced union states between 1977 and 2007. From 1970 to 2013, real personal income in Right to Work states rose twice as fast as forced union states.”

Alabama Right-to-Work, Amendment 8

Americans for Tax Reform Stance: Support

Amendment 8 would add right-to-work to the Alabama Constitution. Though Alabama is currently considered a right-to-work state, but is only on the books as statute. Approval of Amendment 8 would enshrine this important safeguard for worker freedom in the state constitution.

Result: Approved – 61.69% Yes, 30.39% No

Virginia Right-to-Work Amendment

Americans for Tax Reform Stance: Support

Similar to Alabama’s Amendment 8, Virginia’s Right-to-Work would add right-to-work to the Virginia constitution. Virginia already has a Right-to-Work statute on the books.

Result: Defeated – 46.73% Yes, 53.27% No

Significant Local Ballot Measure

Monterey County Ban on Fracking and Extreme Oil Extraction Methods Initiative

Americans for Tax Reform Stance: Oppose

This initiative would ban hydraulic fracturing in Monterey County, California.

Banning energy extraction methods such as hydraulic fracturing prevents the development of affordable, cleaner, reliable, and abundant natural gas. Furthermore, banning hydraulic fracturing will cause Monterey County to forgo economic growth and job-creation.

Result: Approved – 55.53% Yes, 44.47% No