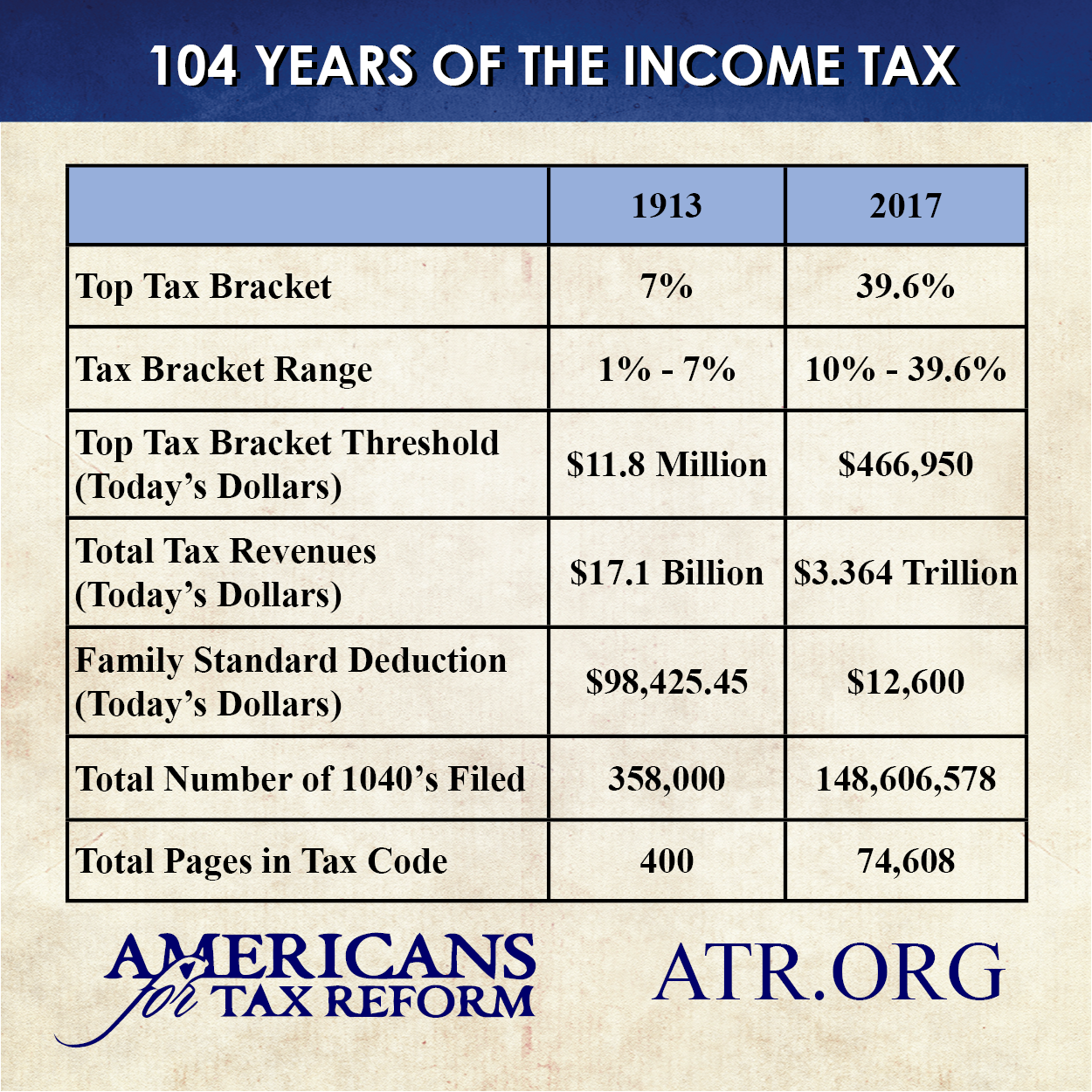

As Americans finish yet another tax filing season, let’s take a look at the 104-year history of the income tax:

- In 1913 the top marginal income tax bracket was 7% — today it is 39.6%.

- In 1913 the marginal income tax bracket range was 1% – 7%. Today the range is 10% – 39.6%.

- In 1913 there were 400 pages in the tax code. Today there are 74,608 pages in the code.

- In 1913 the family standard deduction was $98,425.45 in today’s dollars. The family standard deduction now is just $12,600.

- When the income tax started in 1913, only 358,000 Americans had to file a 1040. Today 148,606,578 Americans file 1040s.

“The American income tax is perhaps the most dramatic example of how government grows at the expense of liberty,”

said Grover Norquist, president of Americans for Tax Reform. “Slowly. Constantly. Inexorably.”

Photo Credit: Chris Potter